Rosetta Stone 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

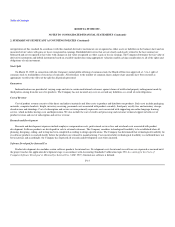

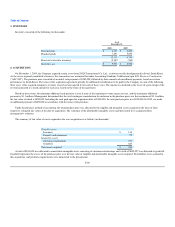

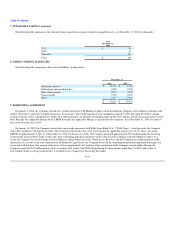

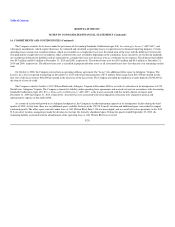

3. INVENTORY

Inventory consisted of the following (in thousands):

As of

December 31,

2010 2009

Raw materials $ 4,423 $ 4,053

Finished goods 7,892 5,696

12,315 9,749

Reserve for obsolete inventory (2,387) (765)

Inventory, net $ 9,928 $ 8,984

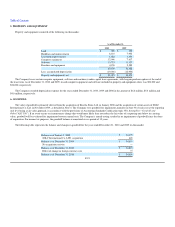

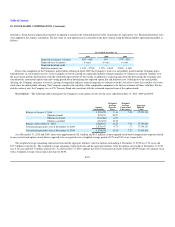

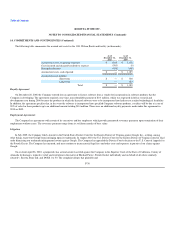

4. ACQUISITIONS

On November 1, 2009, the Company acquired certain assets from SGLC International Co. Ltd., a software reseller headquartered in Seoul, South Korea.

As the assets acquired constituted a business, this transaction was accounted for under Accounting Standards Codification topic 805, Business Combination

("ASC 805"). The purchase price consisted of an initial cash payment of $100,000, followed by three annual cash installment payments, based on revenue

performance in South Korea. The terms of the acquisition agreement provide for additional consideration to be paid by the Company in each of the following

three years, if the acquired company's revenues exceed certain targeted levels each of these years. The amount is calculated as the lesser of a percentage of the

revenue generated or a fixed amount for each year, based on the terms of the agreement.

Based on these terms, the minimum additional cash payment is zero if none of the minimum revenue targets are met, and the maximum additional

payment is $1.1 million. Management determined that the total contingent consideration for inclusion in the purchase price was the maximum of $1.1 million,

the fair value of which is $850,000. Including the cash paid upon the acquisition date of $100,000, the total purchase price was $950,000. In 2010, we made

an additional payment of $400,000 in accordance with the terms of the purchase.

Under the purchase method of accounting, the total purchase price was allocated to the tangible and intangible assets acquired on the basis of their

respective estimated fair values at the date of acquisition. The valuation of the identifiable intangible assets and their useful lives acquired reflects

management's estimates.

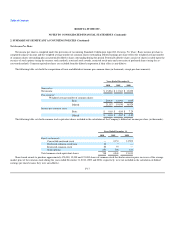

The summary of fair value of assets acquired in the asset acquisition is as follows (in thousands):

Tangible assets:

Inventory $ 135

Property and equipment 95

Intangible assets:

Customer relationships 100

Goodwill 620

Total assets acquired $ 950

A total of $100,000 was allocated to amortizable intangible assets consisting of customer relationships, and a total of $620,257 was allocated to goodwill.

Goodwill represents the excess of the purchase price over the fair value of tangible and amortizable intangible assets acquired. No liabilities were assumed in

this acquisition, and proforma requirements were immaterial to the presentation.

F-20