Rosetta Stone 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

During the last three years, inflation and changing prices have not had a material effect on our business and we do not expect that inflation or changing

prices will materially affect our business in the foreseeable future.

Off-Balance Sheet Arrangements

We do not engage in any off-balance sheet financing arrangements. We do not have any interest in entities referred to as variable interest entities, which

include special purpose entities and other structured finance entities.

Contractual Obligations

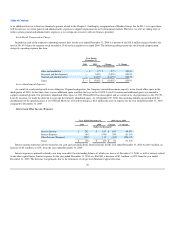

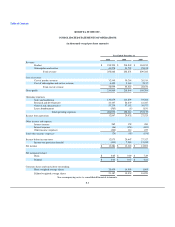

The following table summarizes our contractual obligations at December 31, 2010 and the effect such obligations are expected to have on our liquidity

and cash flow in future periods.

Total Less than 1 Year 1 - 3 Years 3 - 5 Years More than 5 Years

(in thousands)

Long-term debt $ — $ — $ — $ — $ —

Operating lease obligations 12,392 6,611 5,218 563 —

Total $ 12,392 $ 6,611 $ 5,218 $ 563 $ —

The operating lease obligations reflected in the table above include our corporate office leases and site licenses for our kiosks.

We anticipate that we will experience an increase in our capital expenditures and lease commitments consistent with our anticipated growth in

operations, infrastructure and personnel during the remainder of 2011.

Recent Accounting Pronouncements

In December 2009, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2009-17, "Consolidations

(Topic 810)—Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities." ASU No. 2009-17 changes how a reporting

entity determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The

determination of whether a reporting entity is required to consolidate another entity is based on, among other things, the other entity's purpose and design and

the reporting entity's ability to direct the activities of the other entity that most significantly impact the other entity's economic performance. ASU

No. 2009-17 requires a reporting entity to provide additional disclosures about its involvement with variable interest entities and any significant changes in

risk exposure due to that involvement. A reporting entity is required to disclose how its involvement with a variable interest entity affects the reporting entity's

financial statements. ASU No. 2009-17 is effective for fiscal years beginning after November 15, 2009, and interim periods within those fiscal years. We

adopted ASU No. 2009-17 as of January 1, 2010, and its application had no impact on our consolidated financial statements.

In October 2009, the FASB issued ASU No. 2009-13, "Revenue Recognition (Topic 605)—Multiple-Deliverable Revenue Arrangements." ASU

No. 2009-13 addresses the accounting for multiple-deliverable arrangements to enable vendors to account for products or services (deliverables) separately

rather than as a combined unit. ASU No. 2009-13 permits prospective or retrospective adoption. The Company elected prospective adoption during the

quarter ended March 31, 2010. Under the historical accounting principles, the Company was required to account for online services bundled with auxiliary

items, such as headsets and audio companions, using the residual method or by treating the arrangements as one unit of accounting. ASU No. 2009-13

requires the Company to account for the sale of online services

64