Rosetta Stone 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

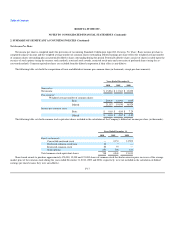

Short-Term Investments

Short-term investments generally consist of highly liquid, fixed-income investments with an original maturity at the time of purchase of greater than

three months. Such investments consist of obligations of the U.S. government and government agencies.

Investments are classified as available-for-sale and stated at fair value. The net unrealized gains or losses on available-for-sale securities are reported as a

component of comprehensive income. The specific identification method is used to compute the realized gains and losses on investments. Investments are

periodically reviewed for impairment. If the carrying value of an investment exceeds its fair value and the decline in value is determined to be other-than-

temporary, an impairment loss is recognized for the difference.

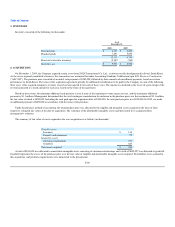

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable consist of amounts due to the Company from its normal business activities. The Company provides an allowance for doubtful

accounts to reflect the expected non-collection of accounts receivable based on past collection history and specific risks identified.

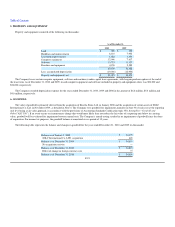

Inventories

Inventories are stated at the lower of cost, determined on a first-in first-out basis, or market. The Company reviews inventory for excess quantities and

obsolescence based on its best estimates of future demand, product lifecycle status and product development plans. The Company uses historical information

along with these future estimates to reserve for obsolete and potential obsolete inventory.

Concentrations of Credit Risk

Accounts receivable and cash and cash equivalents subject the Company to its highest potential concentrations of credit risk. The Company reserves for

credit losses and does not require collateral on its trade accounts receivable. In addition, the Company maintains cash and investment balances in accounts at

various banks and brokerage firms. The Company is insured by the Federal Deposit Insurance Corporation for up to $250,000 at each bank. The Company's

cash and cash equivalents generally exceed the insured limits. The Company has not experienced any losses on cash and cash equivalent accounts to date and

the Company believes it is not exposed to any significant credit risk related to cash. The Company sells products to retailers, resellers, government agencies,

and individual consumers and extends credit based on an evaluation of the customer's financial condition, without requiring collateral. Exposure to losses on

receivables is principally dependent on each customer's financial condition. The Company monitors its exposure for credit losses and maintains allowances

for anticipated losses. No customer accounted for more than 10% of the Company's revenue during the years ended December 31, 2010, 2009 or 2008. The

Company had four customers that accounted for 46% of accounts receivable at December 31, 2010 and three customers that accounted for 47% of accounts

receivable at December 31, 2009.

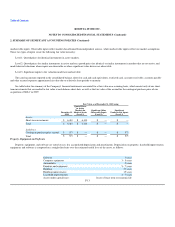

Fair Value of Financial Instruments

In 2008 and 2009, the Company adopted the provisions of ASC No. 820, "Fair Value Measurements." The valuation techniques required by ASC

No. 820 are based upon observable and

F-12