Rosetta Stone 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

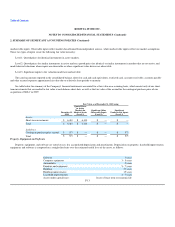

unobservable inputs. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect our market assumptions.

These two types of inputs create the following fair value hierarchy:

Level 1: Quoted prices for identical instruments in active markets.

Level 2: Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and

model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3: Significant inputs to the valuation model are unobservable.

The carrying amounts reported in the consolidated balance sheets for cash and cash equivalents, restricted cash, accounts receivable, accounts payable

and other accrued expenses approximate fair value due to relatively short periods to maturity.

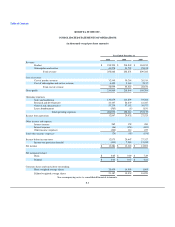

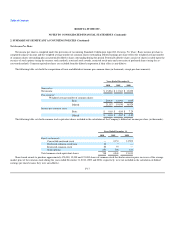

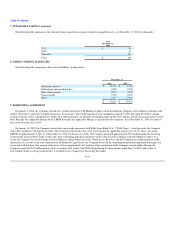

See table below for summary of the Company's financial instruments accounted for at fair value on a recurring basis, which consist only of our short-

term investments that are marked to fair value at each balance sheet date, as well as the fair value of the accrual for the contingent purchase price of our

acquisition of SGLC in 2009:

Fair Value as of December 31, 2010 using:

December 31,

2010

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable Inputs

(Level 3)

Assets:

Short-term investments $ 6,410 $ 6,410 $ — $ —

Total $ 6,410 $ 6,410 $ — $ —

Liabilities:

Contingent purchase price accrual $ 573 $ — $ — $ 573

Total $ 573 $ — $ — $ 573

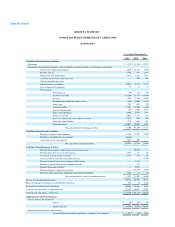

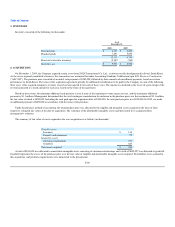

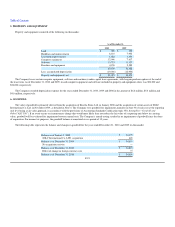

Property, Equipment and Software

Property, equipment, and software are stated at cost, less accumulated depreciation and amortization. Depreciation on property, leasehold improvements,

equipment, and software is computed on a straight-line basis over the estimated useful lives of the assets, as follows:

Software 3 years

Computer equipment 3 - 5 years

Automobiles 5 years

Furniture and equipment 5 - 7 years

Building 39 years

Building improvements 15 years

Leasehold improvements 4 - 7 years

Assets under capital leases lesser of lease term or economic life

F-13