Rosetta Stone 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Expenses for repairs and maintenance that do not extend the life of equipment are charged to expense as incurred. Expenses for major renewals and

betterments, which significantly extend the useful lives of existing property and equipment, are capitalized and depreciated. Upon retirement or disposition of

property and equipment, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized.

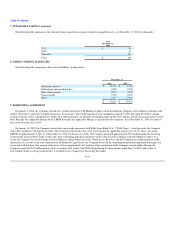

Intangible Assets

Intangible assets consist of acquired technology, including developed and core technology, customer related assets, trade name and trademark and other

intangible assets. Those intangible assets with finite lives are recorded at cost and amortized on a straight line basis over their expected lives in accordance

with Accounting Standards Codification topic 350, Goodwill and Other Intangible Assets ("ASC 350"). On an annual basis, the Company reviews its

indefinite lived intangible assets for impairment based on the fair value of indefinite lived intangible assets as compared to the carrying value in accordance

with ASC 350. In the event the carrying value exceeds the fair value of the assets, the assets are written down to their fair value. There has been no

impairment of intangible assets during any of the periods presented.

Goodwill

In accordance with ASC 350, goodwill is not amortized and is tested for impairment annually on June 30th and whenever events and circumstances

occur indicating goodwill might be impaired. As of June 30, 2010 and 2009, the Company reviewed the goodwill for impairment and determined that no

impairment of goodwill was identified during any of the periods presented.

Valuation of Long-Lived Assets

In accordance with Accounting Standards Codification topic 360, Accounting for the Impairment or Disposal of Long-lived Assets ("ASC 360"), the

Company evaluates the recoverability of its long-lived assets. ASC 360 requires recognition of impairment of long-lived assets in the event that the net book

value of such assets exceeds the future undiscounted net cash flows attributable to such assets. Impairment, if any, is recognized in the period of identification

to the extent the carrying amount of an asset exceeds the fair value of such asset. Based on its analysis, the Company believes that no impairment of its long-

lived assets was indicated as of December 31, 2010 and 2009.

Financial Instruments with Characteristics of Both Liabilities and Equity

The Company issues financial instruments that have characteristics of both liabilities and equity. The Company accounts for these arrangements in

accordance with Accounting Standards Codification topic 480, Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and

Equity ("ASC 480"), as well as related interpretations of this standard.

Derivative Instruments

The Company enters into financing arrangements that consist of freestanding derivative instruments or are hybrid instruments that contain embedded

derivative features. The Company accounts for these arrangements in accordance with Accounting Standards Codification topic 815, Accounting for

Derivative Instruments and Hedging Activities ("ASC 815") as well as related

F-14