Rosetta Stone 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

an office in Germany. In each case we established local sales offices and call centers, added employees and launched marketing and public relations

campaigns within the region. We intend to continue to expand our sales activities within these regions as well as to expand our presence into new countries, in

addition to expanding our media and advertising campaigns in the United States. As a result, we expect sales and marketing expenses to increase in future

periods.

Research and Development. Research and development expenses consist primarily of personnel costs and contract development fees associated with

the development of our solutions. Our development efforts are primarily based in the United States and are devoted to expanding our product portfolio

through the addition of new content and new complimentary products and services to our language learning solutions. We expect our investment in research

and development expenses to increase in future years but provide us with significant benefits in the future.

General and Administrative. General and administrative expenses consist primarily of personnel costs of our executive, finance, legal, human resources

and other administrative personnel, as well as accounting and legal professional services fees and other corporate expenses. We expect general and

administrative expenses to increase in future periods as we expect to continue to invest in corporate infrastructure and incur additional expenses associated

with being a public company, including increased legal and accounting costs, investor relations costs, independent director compensation, exchange listing

fees and stockholder related fees, higher insurance premiums and compliance costs in connection with Section 404 of the Sarbanes-Oxley Act of 2002. In

2011, we expect there will be increases to certain general and administrative expenses to support our expansion into new international markets. However, we

also are taking steps to reduce certain general and administrative expenses as we realign our resources with our business priorities.

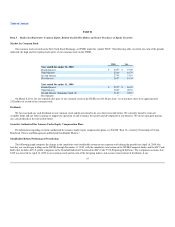

Stock Compensation Charge. Included in the respective operating expense lines for 2009 is an aggregate $18.8 million expense, consisting of

$18.5 million in stock-based compensation expense and $0.3 million in payroll tax expense, related to common stock grants awarded to key employees equal

to a total of 591,491 shares in April 2009. This grant was net of the number of shares required to be withheld to satisfy the federal, state and local tax

withholding obligations. The aggregate grant date fair value of the awards was $18.5 million, which we recognized as stock-based compensation expense on

the grant date, as the awards were immediately vested. We allocated this $18.8 million aggregate expense among the operating expense line items in

accordance with the functions performed by the respective employees who received the grants. No such grant was made in 2010.

Other Income (Expense)

Other income (expense) primarily consists of interest income and interest expense. Interest expense is related to our long-term debt, the outstanding

balance of which was zero as of December 31, 2010. Interest income represents interest received on our cash and cash equivalents.

Income Tax Expense (Benefit)

Income tax expense (benefit) consists of federal, state and foreign income taxes. For the year ended December 31, 2010, our worldwide effective tax rate

was approximately (3%), primarily as a result of the release of the valuation allowance on deferred tax assets in the United Kingdom and Japanese

subsidiaries. We expect our worldwide rate to be approximately 35%-38% in 2011 and beyond assuming no general increase in federal, state or foreign

income tax rates applicable to companies such as ours. We expect our income tax expense to increase in absolute dollars as our income continues to grow.

44