Rosetta Stone 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

accounting principles establish a hierarchy to determine the selling price to be used for allocating revenue to deliverables as follows: (i) vendor-specific

objective evidence of fair value ("VSOE"), (ii) third-party evidence of selling price ("TPE"), and (iii) best estimate of the selling price ("ESP"). VSOE

generally exists only when the Company sells the deliverable separately and is the price actually charged by the Company for that deliverable. ESPs reflect its

best estimates of what the selling prices of elements would be if they were sold regularly on a stand-alone basis.

The Company has identified two deliverables generally contained in arrangements involving the sale of online services bundled with auxiliary items. The

first deliverable is the auxiliary items, which are delivered at the time of sale, and the second deliverable is the online services. The Company allocates

revenue between these two deliverables using the relative selling price method. Amounts allocated to the auxiliary items are recognized at the time of sale,

provided the other conditions for revenue recognition have been met. Amounts allocated to the online services are deferred and recognized on a straight-line

basis over the term of the online services. The auxiliary item cost of sales are generally recognized at the time of sale. Costs for online services and sales and

marketing are expensed as incurred.

The Company has identified two deliverables generally contained in Rosetta Stone V4 TOTALe software arrangements. The first deliverable is the

packaged software, which is delivered at the time of sale, and the second deliverable is the dedicated conversational coaching online services. The Company

allocates revenue between these two deliverables using the relative selling price method. Amounts allocated to the software are recognized at the time of sale,

provided the other conditions for revenue recognition have been met. Amounts allocated to the online services are deferred and recognized on a straight-line

basis over the term of the online services or upon expiry of the online services. The language learning software cost of sales are generally recognized at the

time of sale. Costs for online services and sales and marketing are expensed as incurred.

The Company accounts for multiple element arrangements that consist only of software or software related products, in accordance with industry specific

accounting guidance for software and software related transactions. For such transactions, revenue on arrangements that include multiple elements is allocated

to each element based on the relative fair value of each element, and fair value is generally determined by VSOE. If the Company cannot objectively

determine the fair value of any undelivered element included in such multiple element arrangements, the Company defers revenue until all elements are

delivered and services have been performed, or until fair value can objectively be determined for any remaining undelivered elements.

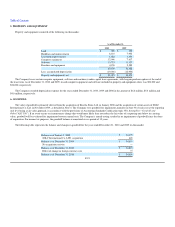

Cash and Cash Equivalents

Cash and cash equivalents consist of highly liquid investments with original maturities of three months or less and demand deposits with financial

institutions.

Restricted Cash

Restricted cash is restricted for the reimbursement of funds to employees under the Company's flexible benefit plan and security for a credit card

processing vendor.

F-11