Redbox 2011 Annual Report Download - page 88

Download and view the complete annual report

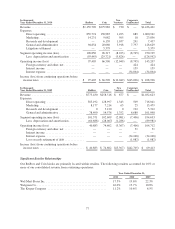

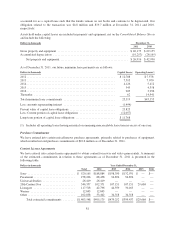

Please find page 88 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the sale transaction, we were required to provide an additional loan of $4.0 million which was added to the

balance of the Sigue Note. We estimate the fair value of the Sigue Note based on the future note payments

discounted at a market rate for similar risk profile companies, which represented our best estimate of default risk,

and was not an exit price based measure of fair value or the stated value on the face of the Sigue Note. The

estimated fair value of the Sigue Note at December 31, 2011 was $24.4 million. We have reported the estimated

fair value of the Sigue Note in our Consolidated Balance Sheets. We evaluate the Sigue Note for collectability on

a quarterly basis. Based on our evaluation at December 31, 2011, an allowance for credit losses was not

established. We recognize interest income on the Sigue Note on an accrual basis unless it is determined that

collection of all principal and interest is unlikely. See Note 4: Discontinued Operations, Sale of Assets and Assets

of Business Held for Sale for additional information about the sale of our Money Transfer Business.

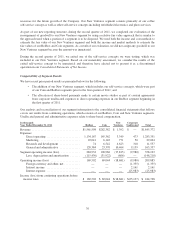

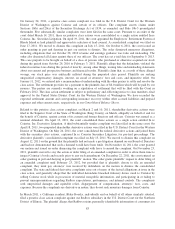

Long-Lived Assets, Goodwill and Other Intangible Assets

During the second quarter of 2011, we performed nonrecurring fair value measurements in connection with

assigning goodwill to our segments. See Note 11: Business Segments and Enterprise-Wide Information for

additional information.

Fair Value of Other Financial Instruments

The carrying value of our cash equivalents, accounts receivable, accounts payable, and our revolving line of

credit approximate their respective fair values due to their short-term nature.

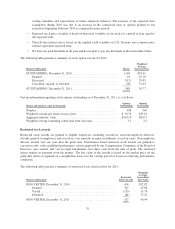

We estimate the fair value of our convertible debt outstanding using the market rate for similar high-yield debt.

The estimated fair value of our convertible debt was $183.4 million and $180.9 million at December 31, 2011

and December 31, 2010, respectively, and was determined based on its stated terms, maturing on September 1,

2014 and an annual interest rate of 4%. We have reported the carrying value of our convertible debt, face value

less the unamortized debt discount, in our Consolidated Balance Sheets.

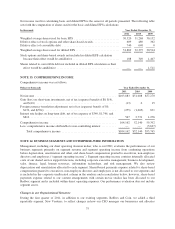

NOTE 18: COMMITMENTS AND CONTINGENCIES

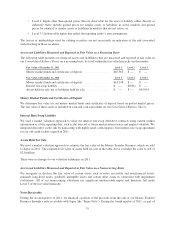

Lease Commitments

Operating Leases

We lease our corporate administrative, marketing, and product development facility in Bellevue, Washington

under operating leases that expire December 31, 2019.

We lease our Redbox facility in Oakbrook Terrace, Illinois under an operating lease that expires on July 31,

2021. Under certain circumstances, we have the ability to extend the lease for a five-year period, rent additional

office space under a right of first offer and refusal and have the option to terminate the lease in July 2016. Under

the terms of the lease, we are responsible for certain tax, construction and operating costs associated with the

rented space.

Rent expense under our operating lease agreements was $8.9 million, $8.3 million and $6.0 million during 2011,

2010 and 2009, respectively.

Capital Leases

We lease automobiles and computer equipment under capital leases expiring at various dates through 2019. In

most circumstances, we expect that, in the normal course of business, these leases will be renewed or replaced by

other leases.

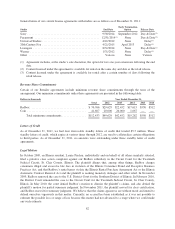

During 2009, we entered into a sales-leaseback transaction in which we sold certain kiosks and leased them back

for the same amount as the sales proceeds. The transaction was considered a financing arrangement and

80