Redbox 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

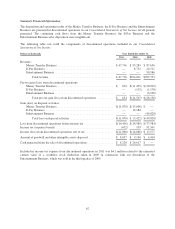

Share-Based Payments for Content Arrangements

We granted restricted stock as part of content license agreements with certain movie studios. The expense related

to these agreements is included within direct operating expenses in our Consolidated Statements of Net Income

and is adjusted based on the number of unvested shares and market price of our common stock each reporting

period. During 2010 and 2009, we entered into agreements with SPHE Scan Based Trading Corporation (“Sony”)

and Paramount Home Entertainment, Inc. (“Paramount”).

During the third quarter of 2011, our agreement with Sony was amended whereby: (i) the scheduled vesting of

certain shares of restricted stock was extended from August 1, 2011 to August 1, 2012; and (ii) the number of

weeks we can offer Sony content in our kiosks was extended from 26 weeks to 52 weeks.

During the fourth quarter of 2011, we entered into an amendment to the revenue sharing license agreement with

Paramount, which provided, among other things, that: (i) Paramount waived its current termination right to end

the licensing arrangement at the end of 2011; (ii) Paramount receives, at its sole discretion, the option for two,

one-year extensions following the initial five-year agreement term, which ends at the end of 2014 (each exercised

extension would provide for a grant of 50,000 shares of restricted stock vesting at the beginning of each

extension); (iii) the content license period was extended from 26 weeks to 52 weeks; and (iv) Paramount was

granted 100,000 shares of restricted stock which will vest according to the vesting schedule of the current

restricted stock purchase agreement with Paramount.

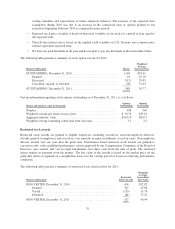

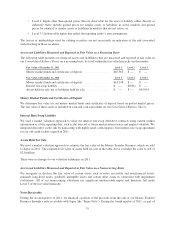

Information related to the shares of restricted stock granted as part of these agreements as of December 31, 2011

is as follows:

Granted Vested Unvested

Remaining

Vesting Period

Sony ................................................. 193,348 19,335 174,013 2.6 years

Paramount ............................................. 300,000 30,000 270,000 3.0 years

Total ............................................. 493,348 49,335 444,013

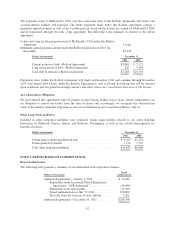

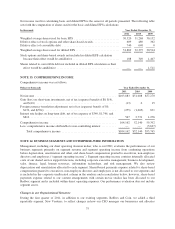

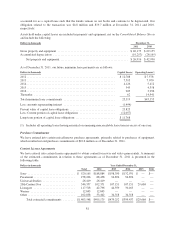

NOTE 11: INCOME TAXES

Components of Income Taxes

The components of income from continuing operations before income taxes were as follows:

Year Ended December 31,

Dollars in thousands 2011 2010 2009

U.S. operations ........................................ $180,084 $106,653 $67,283

Foreign operations ..................................... 4,644 2,273 2,130

Total income from continuing operations before income

taxes .......................................... $184,728 $108,926 $69,413

71