Redbox 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

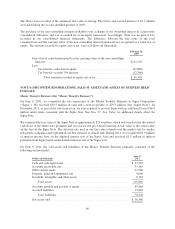

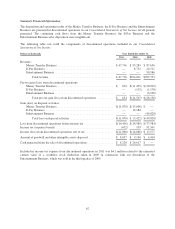

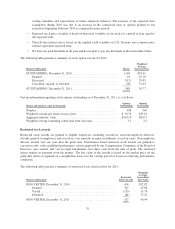

NOTE 8: DEBT AND OTHER LONG-TERM LIABILITIES

Dollars in thousands December 31,

2011 2010

Revolving line of credit .................................. $ — $150,000

Term loan ............................................. 170,625 —

Convertible debt ........................................ 179,697 —

Callable convertible debt ................................. — 173,146

Redbox rollout agreement ................................ 3,268 10,791

Asset retirement obligation ............................... 8,841 7,305

Other long-term liabilities ................................ 10,843 6,688

373,274 347,930

Less:

Current portion of term loan .......................... (10,938) —

Current portion of callable convertible debt .............. — (173,146)

Current portion of Redbox rollout agreement ............. (3,048) (7,523)

Total long-term debt and other long-term liabilities .... $359,288 $ 167,261

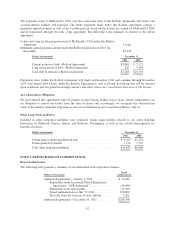

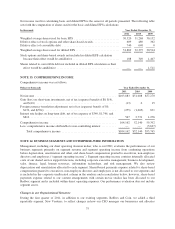

Revolving Line of Credit and Term Loan

On July 15, 2011, we entered into a Second Amended and Restated Credit Agreement (the “New Credit

Facility”), providing for a senior secured revolving credit facility and a senior secured term loan facility, which

replaced our prior credit facility, which consisted of a revolving line of credit. The New Credit Facility provides

for a five-year, $175.0 million term loan and a $450.0 million revolving line of credit. Subject to additional

commitments from lenders, we have the option to increase the aggregate facility size by $250.0 million, which

can be comprised of additional term loans and a revolving line of credit. On July 15, 2011, we borrowed

$175.0 million under the term loan facility, a portion of which was utilized to pay down the revolving line of

credit balance under the prior credit facility of $120.0 million. Fees paid for the New Credit Facility of

$4.2 million were included within other long-term assets on our Consolidated Balance Sheets and are being

amortized over the 5-year life of the New Credit Facility. In addition, $0.9 million of unamortized deferred

finance fees related to the prior credit facility were carried over to the new revolving credit facility arrangement.

Deferred financing costs are amortized on a straight-line basis, which approximates the effective interest method.

The New Credit Facility matures on July 15, 2016, at which time all outstanding borrowings must be repaid. The

term loan is subject to mandatory debt repayments of the outstanding borrowings equal to 5% in the first year,

7.5% in the second year, 10% in the third year, and 12.5% in the fourth and fifth year, with the balance due at

maturity. In 2011, we made principal payments of $4.4 million on the term loan. Our obligations under the New

Credit Facility are secured by a first priority security interest in substantially all of our assets and the assets of

our domestic subsidiaries, as well as a pledge of a substantial portion of our subsidiaries’ capital stock.

Subject to applicable conditions, we may elect interest rates on our revolving borrowings calculated by reference

to (i) the British Bankers Association LIBOR rate (“LIBOR Rate”) fixed for given interest periods or (ii) Bank of

America’s prime rate (or, if greater, the average rate on overnight federal funds plus one half of one percent or

the LIBOR Rate plus one percent) (the “Base Rate”), plus the margin determined by our consolidated net

leverage ratio. For borrowings made under the LIBOR Rate, the margin ranges from 125 to 200 basis points,

while for borrowing made under the Base Rate, the margin ranges from 25 to 100 basis points. However, for the

period through the delivery of our certificate of compliance for the period ending December 31, 2011, the

applicable LIBOR Rate margin was fixed at 150 basis points and the applicable Base Rate margin was fixed at

50 basis points. The interest rate on amounts outstanding under the term loan at December 31, 2011 was 1.78%.

65