Redbox 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

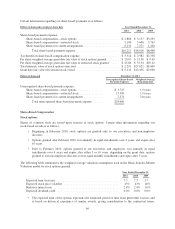

The New Credit Facility contains standard negative covenants and restrictions on actions including, without

limitation, restrictions on indebtedness, liens, fundamental changes or dispositions of our assets, payments of

dividends, capital expenditures, investments, and mergers, dispositions and acquisitions, among other

restrictions. In addition, the New Credit Facility requires that we meet certain financial covenants, ratios and

tests, including maintaining a maximum consolidated net leverage ratio and a minimum interest coverage ratio,

as defined in the New Credit Facility. As of December 31, 2011, we were in compliance with the covenants of

the New Credit Facility.

Convertible Debt

The aggregate outstanding principal of our 4.0% Convertible Senior Notes (the “Notes”) is $200.0 million. The

Notes bear interest at a fixed rate of 4% per annum, payable semi-annually in arrears on each March 1 and

September 1, and mature on September 1, 2014. The effective interest rate at issuance was 8.5%. As of

December 31, 2011, we were in compliance with all covenants.

The Notes become convertible (the “Conversion Event”) when the closing price of our common stock exceeds

$52.38, 130% of the Notes’ conversion price, for more than 20 trading days during the 30 consecutive trading

days prior to each quarter-end date. If the Notes become convertible and should the Note holders elect to convert,

we will be required to pay them up to the full face value of the Notes in cash as well as deliver shares of our

common stock for any excess conversion value. The number of potentially issued shares increases as the market

price of our common stock increases. As of December 31, 2011, the Conversion Event was not met and the Notes

remained classified as a long-term liability on our Consolidated Balance Sheets. In addition, since the Notes were

not convertible at December 31, 2011, the $26.9 million debt conversion feature that was classified as temporary

equity at December 31, 2010 was reclassified to common stock as of December 31, 2011.

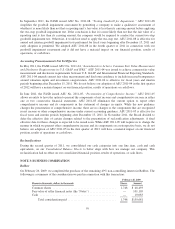

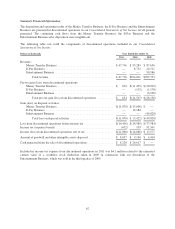

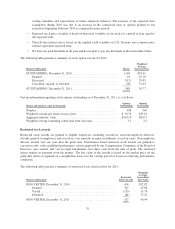

The following interest expense was recorded related to the Notes:

Dollars in thousands Year Ended December 31,

2011 2010 2009

Contractual interest expense ................................ $ 8,000 $ 8,000 $2,333

Amortization of debt discount ............................... 6,551 6,037 1,918

Total interest expense related to the Notes ................. $14,551 $14,037 $4,251

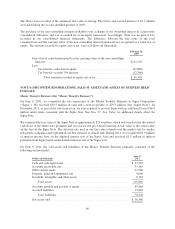

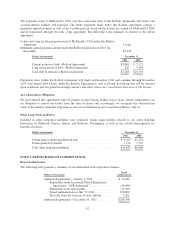

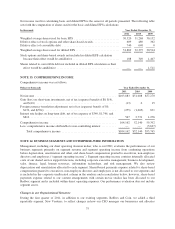

The remaining unamortized debt discount is expected to be recognized as non-cash interest expense as follows

(in thousands):

Year

Non-cash

Interest

Expense

2012 ............................................................. $ 7,108

2013 ............................................................. 7,712

2014 ............................................................. 5,483

Total unamortized discount ....................................... $20,303

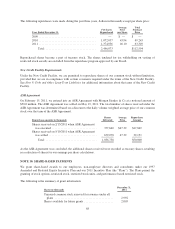

Redbox Rollout Agreement

In November 2006, our Redbox subsidiary and McDonald’s USA entered into a Rollout Purchase, License and

Service Agreement (the “Rollout Agreement”) giving McDonald’s USA and its franchisees and franchise

marketing cooperatives the right to purchase DVD rental kiosks to be located at selected McDonald’s restaurant

sites for which Redbox subsequently received proceeds. The proceeds under the Rollout Agreement are classified

as debt and the interest rate is based on similar rates that Redbox has with its kiosk sale-leaseback transactions.

66