Redbox 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

resources for the future growth of the Company. Our New Ventures segment consists primarily of our coffee

self-service concept as well as other self-service concepts including refurbished electronics and photo services.

As part of our new reporting structure, during the second quarter of 2011, we completed our evaluation of the

reassignment of goodwill to our New Ventures segment by using a relative fair value approach that is similar to

the approach used when a portion of a segment is to be disposed. We used both the income and cost methods to

estimate the fair value of our New Ventures segment and both the income and market methods to estimate the

fair values of our Redbox and Coin segments. As a result of our evaluation, we did not assign any goodwill to our

New Ventures segment because the amount was immaterial.

During the second quarter of 2011, we exited one of the self-service concepts we were testing, which was

included in our New Ventures segment. Based on our materiality assessment, we consider the results of the

exited self-service concept to be immaterial and therefore have elected not to present it as a discontinued

operation in our Consolidated Statements of Net Income.

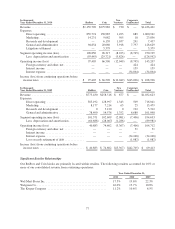

Comparability of Segment Results

We have recast prior period results as presented below for the following:

• The addition of our New Ventures segment, which includes our self-service concepts, which were part

of our Coin and Redbox segments prior to the first quarter of 2011; and

• The allocation of share-based payments made to certain movie studios as part of content agreements

from corporate unallocated expenses to direct operating expenses in our Redbox segment beginning in

the first quarter of 2011.

Our analysis and reconciliation of our segment information to the consolidated financial statements that follows

covers our results from continuing operations, which consists of our Redbox, Coin and New Ventures segments.

Unallocated general and administrative expenses relate to share-based compensation.

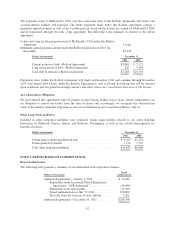

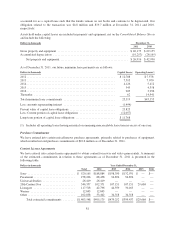

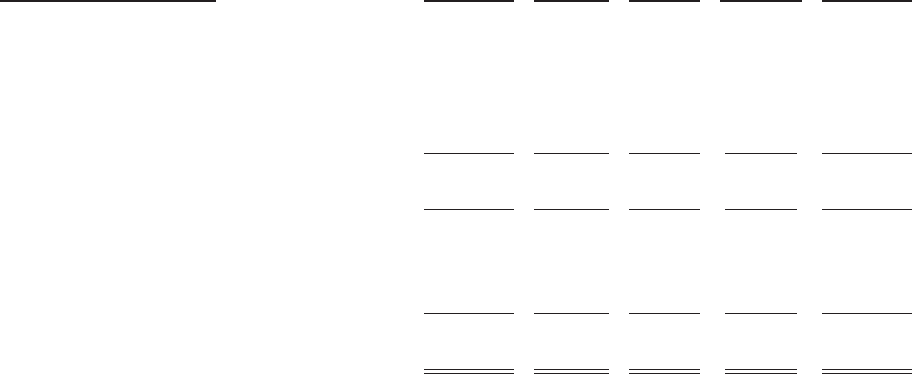

In thousands

Year Ended December 31, 2011 Redbox Coin

New

Ventures

Corporate

Unallocated Total

Revenue ................................. $1,561,598 $282,382 $ 1,392 $ — $1,845,372

Expenses:

Direct operating ....................... 1,134,167 145,362 3,349 473 1,283,351

Marketing ............................ 22,041 6,142 771 50 29,004

Research and development .............. 74 6,542 4,623 318 11,557

General and administrative .............. 120,384 23,370 10,464 9,139 163,357

Segment operating income (loss) ............. 284,932 100,966 (17,815) (9,980) 358,103

Less: depreciation and amortization ....... (115,430) (31,922) (866) — (148,218)

Operating income (loss) .................... 169,502 69,044 (18,681) (9,980) 209,885

Foreign currency and other, net ........... — — — (1,335) (1,335)

Interest income ....................... — — — 2,161 2,161

Interest expense ....................... — — — (25,983) (25,983)

Income (loss) from continuing operations before

income taxes ........................... $ 169,502 $ 69,044 $(18,681) $(35,137) $ 184,728

76