Redbox 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

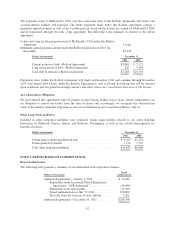

The net assets disposed represent the fair value less cost to sell the Money Transfer Business. The loss on

disposal activities recognized in 2011 and 2010 was allocated to the asset disposal group including property,

plant and equipment, net, intangible and other assets.

During the second quarter of 2010, the Money Transfer Business asset group met accounting requirements to be

presented as assets held for sale in our Consolidated Balance Sheets and a discontinued operation in our

Consolidated Statements of Net Income. The business assets and liabilities held for sale were reported based on

their estimated fair value less cost to sell estimated using the market approach. The carrying value of the assets

and liabilities exceeded the estimated fair value less cost to sell thereby failing step one of our impairment test.

Upon conducting step two of the impairment test, the implied goodwill of the Money Transfer Business exceeded

the carrying value of its goodwill resulting in no goodwill impairment. We performed our goodwill impairment

test each quarter thereafter until disposition. During 2010, there was no goodwill impairment. In 2009, the

Money Transfer Business failed our goodwill impairment test, which resulted in a charge of $7.4 million in the

fourth quarter of 2009, which is included within income (loss) from discontinued operations, net of tax on our

Consolidated Statements of Net Income for 2009.

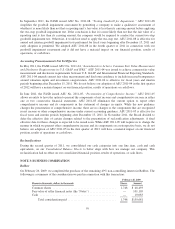

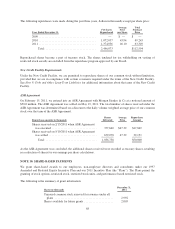

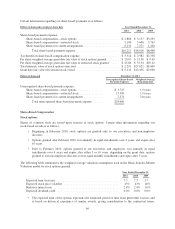

Electronic Payment Business (the “E-Pay Business”)

On May 25, 2010, we sold our subsidiaries comprising the E-Pay Business to InComm Holdings, Inc. and

InComm Europe Limited (collectively “InComm”) for an aggregate purchase price of $40.0 million. In addition,

the purchase price was subject to a post-closing net working capital adjustment in the amount of $0.5 million,

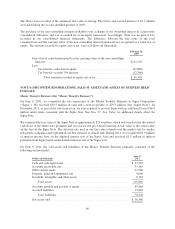

which was finalized in October 2010. The disposed assets and liabilities consisted of the following:

Dollars in thousands

May 25,

2010

Current assets ...................................................... $24,862

Property, plant and equipment, net ..................................... 2,574

Goodwill, intangible, and other assets ................................... 11,638

Total assets .................................................... 39,074

Current liabilities ................................................... 27,717

Net assets sold ..................................................... $11,357

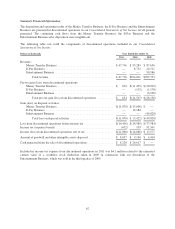

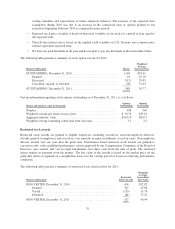

Entertainment Business

On September 8, 2009, we sold our subsidiaries comprising our Entertainment Business to National

Entertainment Network, Inc. (“National”) for nominal consideration. With the transaction, National assumed the

operations of the Entertainment Business, including substantially all of the Entertainment Business’s related

assets and liabilities. The disposed assets and liabilities consisted of the following:

Dollars in thousands

September 8,

2009

Current assets ................................................... $29,378

Property, plant and equipment, net ................................... 35,233

Intangible assets ................................................. 4,410

Other assets ..................................................... 3,062

Total assets ................................................. 72,083

Total liabilities ................................................... 25,596

Net assets sold ................................................... $46,487

As a result of the sale, we recorded a pre-tax loss on disposal of $49.8 million and a one-time tax benefit of $82.2

million during the third quarter of 2009.

61