Redbox 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

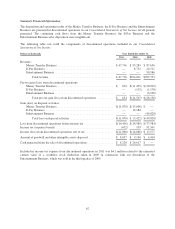

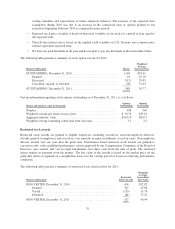

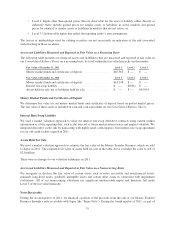

Components of Income Tax Expense

The components of income tax expense were as follows:

Dollars in thousands Year Ended December 31,

2011 2010 2009

Current:

U.S. Federal ................................................ $ — $ — $ 8,305

State and local ............................................... 9,326 1,003 1,511

Foreign .................................................... 375 634 1,222

Total current .................................................... 9,701 1,637 11,038

Deferred:

U.S. Federal ................................................ 58,858 36,957 12,581

State and local ............................................... 580 4,703 2,738

Foreign .................................................... 638 (265) (637)

Total deferred ................................................... 60,076 41,395 14,682

Total income tax expense .......................................... $69,777 $43,032 $25,720

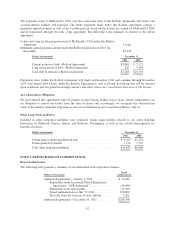

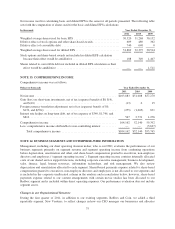

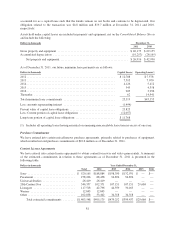

Rate Reconciliation

The income tax expense differs from the amount that would result by applying the U.S. statutory rate to income

before income taxes as follows:

Year Ended December 31,

2011 2010 2009

U.S Federal tax expense at statutory rates ............................. 35.0% 35.0% 35.0%

State income taxes, net of federal benefit .......................... 4.3% 3.5% 3.8%

Non-controlling interest ....................................... — — (1.8)%

Federal and state credits ....................................... (0.6)% — —

Other ...................................................... (0.9)% 1.0% 0.1%

Effective tax rate ................................................. 37.8% 39.5% 37.1%

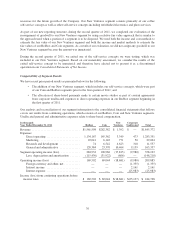

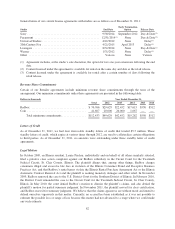

Unrecognized Tax Benefits

The aggregate changes in the balance of unrecognized tax benefits were as follows:

Dollars in thousands Year ended December 31,

2011 2010 2009

Balance, beginning of the year ...................................... $1,821 $1,800 $1,200

Additions based on tax positions related to the current year ........... 315 70 100

Additions for tax positions related to prior years .................... 420 — 500

Reductions for tax positions related to prior years ................... — (39) —

Reductions from lapse of applicable statute of limitations ............. — (10) —

Settlements ................................................. (101) — —

Balance, end of year .............................................. $2,455 $1,821 $1,800

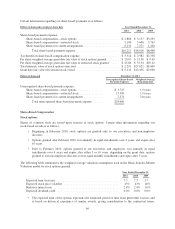

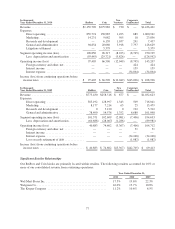

At December 31, 2011, the unrecognized tax benefits were primarily related to R&D credit and income/expense

recognition, all of which would have an effect on our effective tax rate if recognized. It was not necessary to

accrue interest and penalties associated with the uncertain tax positions identified because operating losses and

tax credit carryforwards were sufficient to offset all unrecognized tax benefits.

72