Redbox 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

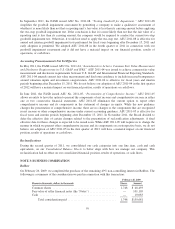

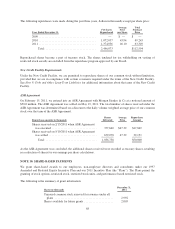

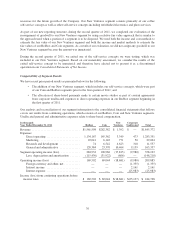

Certain information regarding our share-based payments is as follows:

Dollars in thousands except per share data Year Ended December 31,

2011 2010 2009

Share-based payments expense:

Share-based compensation—stock options ............................ $ 2,880 $ 3,137 $3,295

Share-based compensation—restricted stock ........................... 7,100 5,608 3,763

Share-based payments for content arrangements ........................ 6,231 7,271 1,410

Total share-based payments expense ............................. $16,211 $16,016 $8,468

Tax benefit on share-based compensation expense .......................... $ 3,514 $ 2,982 $2,338

Per share weighted average grant date fair value of stock options granted ........ $ 20.67 $ 15.38 $ 9.49

Per share weighted average grant date fair value of restricted stock granted ...... $ 45.86 $ 33.34 $29.12

Total intrinsic value of stock options exercised ............................. $ 2,291 $27,622 $8,400

Grant date fair value of restricted stock vested ............................. $ 5,132 $12,456 $2,600

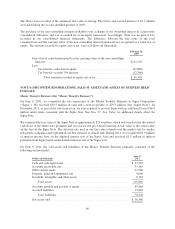

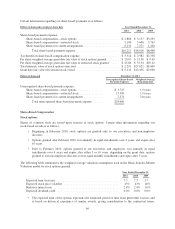

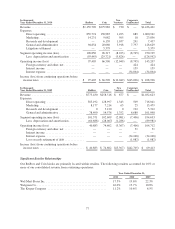

Dollars in thousand December 31, 2011

Unrecognized Share-Based

Payments Expense

Weighted-Average

Remaining Life

Unrecognized share-based payments expense:

Share-based compensation—stock options ................. $ 3,725 1.5 years

Share-based compensation—restricted stock ................ 13,309 1.9 years

Share-based payments for content arrangements ............. 7,572 2.8 years

Total unrecognized share-based payments expense ....... $24,606

Share-Based Compensation

Stock options

Shares of common stock are issued upon exercise of stock options. Certain other information regarding our

stock-based awards is as follows:

• Beginning in February 2010, stock options are granted only to our executives and non-employee

directors.

• Options granted after February 2010 vest annually in equal installments over 4 years, and expire after

10 years.

• Prior to February 2010, options granted to our executives and employees vest annually in equal

installments over 4 years and expire after either 5 or 10 years, depending on the grant date; options

granted to our non-employee directors vest in equal monthly installments and expire after 5 years.

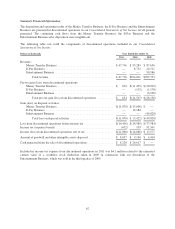

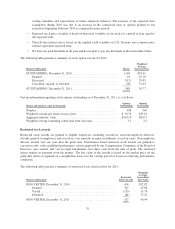

The following table summarizes the weighted average valuation assumptions used in the Black-Scholes-Merton

Valuation model for stock options granted:

Year Ended December 31,

2011 2010 2009

Expected term (in years) .......................................... 7.3 7.3 3.7

Expected stock price volatility ..................................... 43% 43% 40%

Risk-free interest rate ............................................ 2.8% 2.4% 1.6%

Expected dividend-yield .......................................... 0.0% 0.0% 0.0%

• The expected term of the options represents the estimated period of time from grant until exercise and

is based on historical experience of similar awards, giving consideration to the contractual terms,

69