Redbox 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•New Ventures—New Ventures revenue is recognized when the sale of product or service transaction

through our new concept kiosks is completed. Consumers either pay cash or use credit or debit cards

when they purchase products or services from our New Venture segment. Our New Venture segment

currently offers coffee, refurbished electronics, and photo services to our consumers.

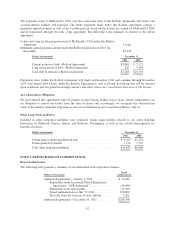

Fees Paid to Retailers

Fees paid to retailers relate to the amount we pay our retailers for the benefit of placing our kiosks in their stores

and their agreement to provide certain services on our behalf to our consumers. The fee is generally calculated as

a percentage of each coin-counting transaction or as a percentage of our net movie or video game rental revenue

and is recorded in our Consolidated Statements of Net Income within the direct operating expenses. The fee

arrangements are based on our negotiations and evaluation of certain factors with the retailers such as total

revenue, long-term non-cancelable contracts, installation of our kiosks in high traffic and/or urban or rural

locations, co-op marketing incentives, or other criteria.

Advertising

Advertising costs, which are included as a component of marketing expenses, are expensed as incurred and

totaled $15.9 million, $15.4 million and $10.8 million in 2011, 2010 and 2009, respectively.

Research and Development

Costs incurred for research and development activities are expensed as incurred.

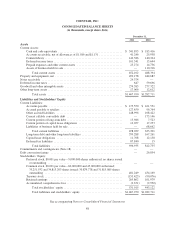

Foreign Currency Translation

The functional currencies of our international subsidiaries are the British pound Sterling for our subsidiary

Coinstar Limited in the United Kingdom, Canadian dollar for Coinstar International, and the Euro for our

subsidiaries Coinstar Money Transfer and Coinstar Ireland Limited. We translate assets and liabilities related to

these operations to U.S. dollars at the exchange rate in effect at the date of the Consolidated Balance Sheets;we

convert revenues and expenses into U.S. dollars using average exchange rates. Translation gains and losses are

reported as a separate component of accumulated other comprehensive loss.

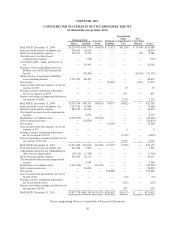

Share-Based Payments

We measure and recognize expense for all share-based payment awards granted, including employee stock

options and restricted stock awards, based on the estimated fair value of the award on the grant date. We utilize

the Black-Scholes-Merton (“BSM”) valuation model for valuing our stock option awards and the determination

of the expenses.

The use of the BSM valuation model to estimate the fair value of stock option awards requires us to make

judgments on assumptions regarding the risk-free interest rate, expected dividend yield, expected term and

expected volatility over the expected term of the award. The assumptions used in calculating the fair value of

share-based payment awards represent management’s best estimates at the time they are made, but these

estimates involve inherent uncertainties and the determination of expense could be materially different in the

future.

We amortize share-based payment expense on a straight-line basis over the vesting period of the individual

award with estimated forfeitures considered. Vesting periods are generally four years. Shares to be issued upon

the exercise of stock options will come from newly issued shares. The expense related to restricted stock granted

to movie studios as part of license agreements is adjusted based on the number of unvested shares and market

price of our common stock each reporting period.

57