Redbox 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

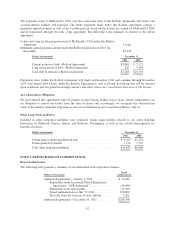

The Notes were recorded at the estimated fair value at closing. The Notes and accrued interest of $2.7 million

were paid during the second and third quarters of 2009.

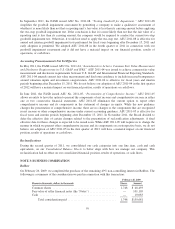

The purchase of the non-controlling interests in Redbox was a change of our ownership interest in a previously

consolidated subsidiary and was accounted for as an equity transaction. Accordingly, there was no gain or loss

recorded in our consolidated financial statements. The difference between the fair value of the total

considerations and the carrying value of the non-controlling interest purchased was recognized as a reduction of

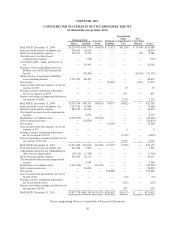

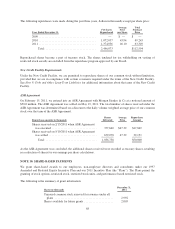

equity. The amounts recorded to equity, net of tax, were as follows (in thousands):

February 26,

2009

Fair value of consideration paid less the carrying value of the non-controlling

interests ...................................................... $112,529

Less:

Tax benefit—reduction in equity ................................ (43,886)

Tax benefit—section 754 election ................................ (12,340)

Total amounts recorded to equity, net of tax .................... $ 56,303

NOTE 4: DISCONTINUED OPERATIONS, SALE OF ASSETS AND ASSETS OF BUSINESS HELD

FOR SALE

Money Transfer Business (the “Money Transfer Business”)

On June 9, 2011, we completed the sale transaction of the Money Transfer Business to Sigue Corporation

(“Sigue”). We received $19.5 million in cash and a note receivable of $29.5 million (the “Sigue Note”). In

December 2011, as part of the sale transaction, we were required to provide Sigue with an additional loan of $4.0

million under terms consistent with the Sigue Note. See Note 17: Fair Value for additional details about the

Sigue Note.

We estimated the fair value of the Sigue Note at approximately $24.4 million, which was based on the discounted

cash flows of the future note payments and was not an exit price based measure of fair value or the stated value

on the face of the Sigue Note. The discount rate used in our fair value estimate was the market rate for similar

risk profile companies and represented our best estimate of default risk. During 2011, we recognized $1.9 million

of interest income base on the imputed interest rate of the Sigue Note and received $1.3 million in interest

payments from Sigue based on the nominal interest rate of the Sigue note.

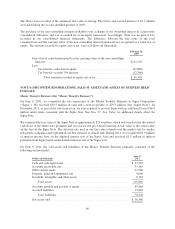

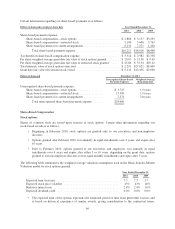

On June 9, 2011, the sold assets and liabilities of the Money Transfer Business primarily consisted of the

following (in thousands):

Dollars in thousands

June 9,

2011

Cash and cash equivalents ........................................... $ 57,893

Accounts receivable, net ............................................ 33,185

Other current assets ................................................ 13,560

Property, plant and equipment, net .................................... 4,066

Goodwill, intangible, and other assets .................................. 8,162

Total assets ................................................... 116,866

Accounts payable and payable to agents ................................ 65,464

Accrued liabilities ................................................. 13,062

Total liabilities ................................................ 78,526

Net assets sold .................................................... $ 38,340

60