Redbox 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our consolidated financial statements

and related notes thereto included elsewhere in this Annual Report. Except for the consolidated historical

information, the following discussion contains forward-looking statements. Actual results could differ from those

projected in the forward-looking statements. Please refer to “Special Note Regarding Forward-Looking

Statements” and “Risk Factors” elsewhere in this Annual Report.

Changes in Our Organizational Structure

During the first quarter of 2011, in addition to our existing Redbox and Coin segments, we added a third

reportable segment, New Ventures, to reflect changes in how our chief executive officer (“CEO”) manages our

businesses and allocates resources for the future growth of the company. Our New Ventures segment consists

primarily of our Coffee self-service concept and includes certain other self-service concepts such as refurbished

electronics and photo services.

As part of our new reporting structure, during the second quarter of 2011, we completed our evaluation of the

reassignment of goodwill to our New Ventures segment by using a relative fair value approach that is similar to

the approach used when a portion of a segment is to be disposed. We used both the income and cost methods to

estimate the fair value of our New Ventures segment and both the income and market methods to estimate the

fair values of our Redbox and Coin segments. As a result of our evaluation, we did not assign any goodwill to our

New Ventures segment because the amount was immaterial.

During the second quarter of 2011, we exited one of the self-service concepts we were testing, which was

included in our New Ventures segment. Based on our materiality assessment, we consider the results of that self-

service concept to be immaterial and therefore have elected not to present it as a discontinued operation in our

Consolidated Statements of Net Income.

Comparability of Segment Results

We have recast prior period results for the following:

• The addition of our New Ventures segment, which includes our self-service concepts, which were part

of our Coin and Redbox segments prior to the first quarter of 2011; and

• The allocation of share-based payments made to certain movie studios as part of content agreements

from corporate unallocated expenses to direct operating expenses in our Redbox segment beginning in

the first quarter of 2011.

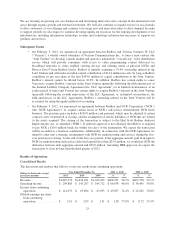

Overview

We are a leading provider of automated retail solutions offering convenient products and services that benefit

consumers and drive incremental retail traffic and revenue for retailers. Our core offerings in automated retail

include our Redbox segment, where consumers can rent or purchase movies and video games from self-service

kiosks, and our Coin segment, where consumers can convert their coin to cash or stored value products at self-

service coin-counting kiosks. Our New Ventures segment is focused on identifying, evaluating, building, and

developing innovative self-service concepts in the marketplace.

Our strategy is based upon leveraging our core competencies in the automated retail space to provide the

consumer with convenience and value and to help retailers drive incremental traffic and revenue. Our

competencies include success in building strong consumer and retailer relationships, and in deploying, scaling

and managing kiosk businesses. We build strong consumer relationships by providing valuable self-service

products and services in convenient locations. We build strong retailer relationships by providing retailers with

turnkey solutions that complement their businesses without significant outlays of time and financial resources.

24