Redbox 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

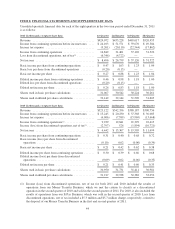

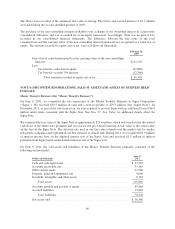

COINSTAR, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

For the year ended December 31,

2011 2010 2009

Operating Activities:

Net income .................................................................... $103,883 $ 51,008 $ 57,270

Adjustments to reconcile net income to net cash flows from operating activities from continuing

operations:

Depreciation and other ....................................................... 145,478 123,687 86,418

Amortization of intangible assets and deferred financing fees ......................... 5,182 5,338 5,037

Share-based payments expense ................................................. 16,211 16,016 8,816

Excess tax benefits on share-based payments ...................................... (2,471) (6,887) —

Deferred income taxes ....................................................... 60,076 41,395 14,682

Loss (income) from discontinued operations, net of tax .............................. 11,068 14,886 (13,577)

Non-cash interest on convertible debt ............................................ 6,551 6,037 1,918

Other ..................................................................... 1,496 666 1,943

Cash flows from changes in operating assets and liabilities from continuing operations:

Accounts receivable ......................................................... (15,289) (7,087) (3,450)

Content library ............................................................. (2,062) (44,985) (27,736)

Prepaid expenses and other current assets ........................................ (4,869) (9,295) (2,224)

Other assets ................................................................ 1,769 1,793 (1,724)

Accounts payable ........................................................... 12,550 81,368 (12,774)

Accrued payable to retailers ................................................... 30,826 4,252 (5,601)

Other accrued liabilities ...................................................... 36,117 37,427 14,892

Net cash flows from operating activities from continuing operations ............ 406,516 315,619 123,890

Investing Activities:

Purchases of property and equipment ................................................ (179,236) (170,847) (148,467)

Proceeds from sale of property and equipment ......................................... 695 1,143 362

Proceeds from sale of businesses, net ................................................ 8,220 26,617 —

Equity investments .............................................................. (4,912) — —

Net cash flows from investing activities from continuing operations ............. (175,233) (143,087) (148,105)

Financing Activities:

Principal payments on capital lease obligations and other debt ............................ (28,202) (36,312) (27,204)

Proceeds from capital lease financing ................................................ — — 22,020

Borrowings from term loan ........................................................ 175,000 — —

Principal payments on term loan .................................................... (4,375) — (87,500)

Net payments on revolving line of credit ............................................. (150,000) (75,000) 42,500

Issuance of convertible debt ....................................................... — — 194,000

Financing costs associated with credit facility and convertible debt ........................ (4,196) — (3,984)

Payment of loan related to the purchase of non-controlling interest in Redbox ................ — — (113,867)

Excess tax benefits related to share-based payments .................................... 2,471 6,887 —

Repurchases of common stock and ASR program ...................................... (63,349) (49,245) —

Proceeds from exercise of stock options .............................................. 3,261 31,624 15,974

Net cash flows from financing activities from continuing operations ............ (69,390) (122,046) 41,939

Effect of exchange rate changes on cash ................................................ (454) (637) 3,466

Increase in cash and cash equivalents from continuing operations .......................... 161,439 49,849 21,190

Cash flows from discontinued operations:

Operating cash flows ............................................................. 9,678 (9,524) (8,272)

Investing cash flows ............................................................. (12,678) (2,600) (5,026)

Financing cash flows ............................................................. — (166) (2,536)

Net cash flows from discontinued operations ................................ (3,000) (12,290) (15,834)

Increase in cash and cash equivalents .................................................. 158,439 37,559 5,356

Cash and cash equivalents:

Beginning of period ............................................................. 183,416 145,857 140,501

End of period ................................................................... $341,855 $ 183,416 $ 145,857

Supplemental disclosure of cash flow information from continuing operations:

Cash paid during the period for interest ...................................... $ 16,221 $ 26,219 $ 27,970

Cash paid during the period for income taxes .................................. $ 5,393 $ 2,668 $ 1,332

Supplemental disclosure of non-cash investing and financing activities from continuing

operations:

Purchases of property and equipment financed by capital lease obligations .......... $ 15,122 $ 7,079 $ 13,399

Purchases of property and equipment included in ending accounts payable .......... $ 12,432 $ 10,976 $ 10,788

Non-cash consideration received from sale of the Money Transfer Business ......... $ 23,826 $ — $ —

Non-cash consideration for the purchase of Redbox non-controlling interest ......... $ — $ — $ 48,493

Underwriting discount and commissions on convertible debt ..................... $ — $ — $ 6,000

See accompanying Notes to Consolidated Financial Statements

51