Redbox 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

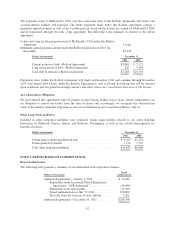

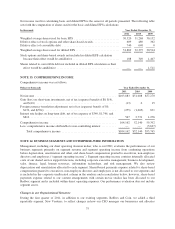

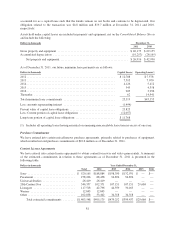

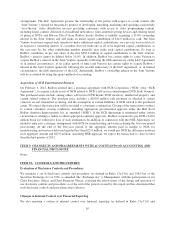

Net income used for calculating basic and diluted EPS is the same for all periods presented. The following table

sets forth the computation of shares used for the basic and diluted EPS calculations:

In thousands Year Ended December 31,

2011 2010 2009

Weighted average shares used for basic EPS ............................... 30,520 31,268 30,152

Dilutive effect of stock options and other share-based awards .................. 609 489 362

Dilutive effect of convertible debt ....................................... 740 640 0

Weighted average shares used for diluted EPS .............................. 31,869 32,397 30,514

Stock options and share-based awards not included in diluted EPS calculation

because their effect would be antidilutive ................................ 108 349 1,407

Shares related to convertible debt not included in diluted EPS calculation as their

effect would be antidilutive ........................................... — — 1,511

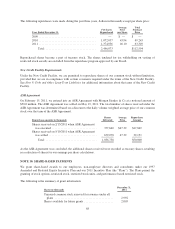

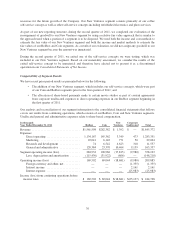

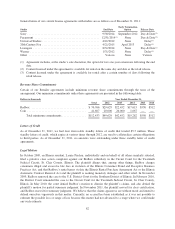

NOTE 13: COMPREHENSIVE INCOME

Comprehensive income was as follows:

Dollars in thousands Year Ended December 31,

2011 2010 2009

Net income ....................................................... $103,883 $51,008 $57,270

Gain (loss) on short-term investments, net of tax (expense) benefit of $8, $(4),

and $(10) ...................................................... (13) 6 15

Foreign currency translation adjustment, net of tax (expense) benefit of $0,

$132, and $(394) ................................................ (255) (1,605) 831

Interest rate hedges on long-term debt, net of tax expense of $349, $1,746, and

$816 .......................................................... 547 2,731 1,276

Comprehensive income ............................................. 104,162 52,140 59,392

Less: comprehensive income attributable to non-controlling interest .......... — — (3,627)

Total comprehensive income ..................................... $104,162 $52,140 $55,765

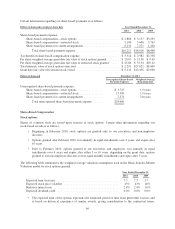

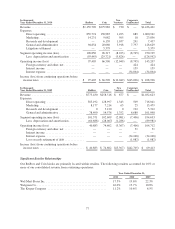

NOTE 14: BUSINESS SEGMENTS AND ENTERPRISE-WIDE INFORMATION

Management, including our chief operating decision maker, who is our CEO, evaluates the performances of our

business segments primarily on segment revenue and segment operating income from continuing operations

before depreciation, amortization and other, and share-based compensation granted to executives, non-employee

directors and employees (“segment operating income”). Segment operating income contains internally allocated

costs of our shared service support functions, including corporate executive management, business development,

sales, finance, legal, human resources, information technology, and risk management. We also review

depreciation and amortization allocated to each segment. Shared-based payments expense related to share-based

compensation granted to executives, non-employee directors and employees is not allocated to our segments and

is included in the corporate unallocated column in the analysis and reconciliation below; however, share-based

payments expense related to our content arrangements with certain movie studios has been allocated to our

Redbox segment and is included within direct operating expenses. Our performance evaluation does not include

segment assets.

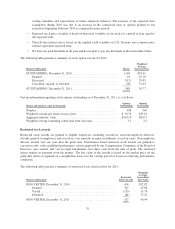

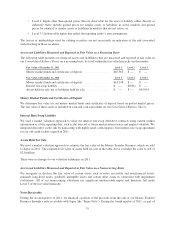

Changes in our Organizational Structure

During the first quarter of 2011, in addition to our existing segments, Redbox and Coin, we added a third

reportable segment, New Ventures, to reflect changes in how our CEO manages our businesses and allocates

75