Redbox 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.remained unchanged. The price increase was instituted primarily as a result of higher operating

expenses, including increased regulated debit card interchange fees.

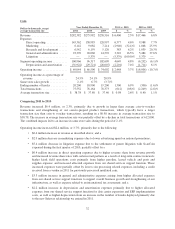

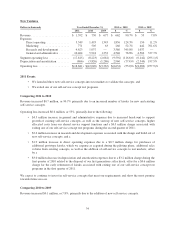

Comparing 2011 to 2010

Revenue increased $401.9 million, or 34.7% primarily due to the following:

• $206.5 million from same store sales growth of 18.3%; and

• $195.4 million from new kiosk installations.

Both amounts reflect the benefit of the increase in the daily rental fee from $1.00 to $1.20 in late October 2011

on standard definition rentals, as well as a $0.12 increase in net revenue per rental primarily due to continued

growth in video game rentals, which were rolled out nationally in June 2011, and Blu-ray rentals, both of which

have higher daily rental fees.

Operating income increased $72.1 million, or 74.0%, primarily due to the following:

• $401.9 million increase in revenue as described above; partially offset by a

• $274.4 million increase in direct operating expenses attributable to revenue growth, including higher

than optimal DVD product costs related to purchases of December 2010 and January 2011 titles, as

well as increased game product costs in support of our national video game rollout in June 2011,

increased revenue share and payment card processing fees and increased kiosk field operations

expenses. Partially offsetting these increases were extensions of the DVD license amortization periods

from 26 weeks to 52 weeks for certain studios due to amended agreements and lower restricted stock

expense due to a lower market price of our common stock on the last day of the calculation period

when compared to the prior period. As our installed kiosk base grows, we continue to better utilize our

existing field resources and lower the servicing costs per kiosk. Direct operating expenses as a percent

of revenue for 2011 was 72.6%, down 1.5 percentage points from 74.1% in 2010;

• $25.5 million increase in general and administrative expenses primarily related to supporting overall

business growth and strengthening of our infrastructure, including the company-wide implementation

of an ERP system. As in past periods, we continue to leverage our general and administrative expenses

as they decreased as a percent of revenue 0.5 percentage points from 8.2% in 2010 to 7.7% in 2011;

• $22.0 million increase in depreciation and amortization expenses due to growth in the installed kiosk

base, as well as the continued build-out of our technology infrastructure, partially offset by $5.5 million

of accelerated depreciation in 2010 related to the 2010 closure of our DVDXpress branded kiosks; and

a

• $7.8 million increase in marketing expenses due to affiliate programs, search engine marketing, and

promotional email, as well as additional studio marketing during 2011.

On January 31, 2012, we announced that our contract with Warner Brothers expired and that we will work to

provide Warner Brothers content for rental in our Redbox kiosks through alternative means.

Comparing 2010 to 2009

Revenue increased $386.3 million, or 49.9%, primarily due to the following:

• $288.1 million from new kiosk installations; and

• $98.2 million from same store sales growth of 13.0%.

Both amounts reflect the benefit of an $0.11 increase in net revenue per rental, primarily due to an increase in the

average number of nights per consumer rental and the expanded offering of video game rentals in certain

markets.

30