Redbox 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

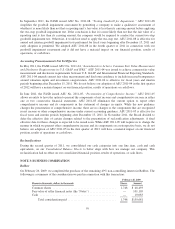

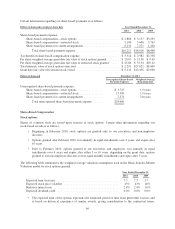

Summary Financial Information

The disposition and operating results of the Money Transfer Business, the E-Pay Business and the Entertainment

Business are presented in discontinued operations in our Consolidated Statements of Net Income for all periods

presented. The continuing cash flows from the Money Transfer Business, the E-Pay Business and the

Entertainment Business after disposition were insignificant.

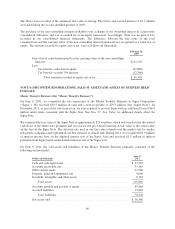

The following table sets forth the components of discontinued operations included in our Consolidated

Statements of Net Income:

Dollars in thousands Year Ended December 31,

2011 2010 2009

Revenue:

Money Transfer Business ...................................... $47,716 $ 95,289 $ 87,656

E-Pay Business .............................................. — 8,732 24,511

Entertainment Business ........................................ — — 90,586

Total revenue ........................................... $47,716 $104,021 $202,753

Pre-tax gain (loss) from discontinued operations:

Money Transfer Business ...................................... $ 654 $(11,435) $ (20,022)

E-Pay Business .............................................. — (132) (1,178)

Entertainment Business ........................................ — — (6,956)

Total pre-tax gain (loss) from discontinued operations ........... $ 654 $(11,567) $ (28,156)

Gain (loss) on disposal activities:

Money Transfer Business ...................................... $(11,070) $ (15,606) $ —

E-Pay Business .............................................. — 12,184 —

Entertainment Business ........................................ — — (49,828)

Total loss on disposal activities ............................. $(11,070) $ (3,422) $ (49,828)

Loss from discontinued operations before income tax .................... $(10,416) $ (14,989) $ (77,984)

Income tax (expense) benefit ....................................... (652) 103 91,561

Income (loss) from discontinued operations, net of tax ................... $(11,068) $ (14,886) $ 13,577

Amount of goodwill and other intangible assets disposed ................. $ 8,037 $ 9,100 $ 4,410

Cash generated from the sale of discontinued operations .................. $ 8,220 $ 26,617 $ —

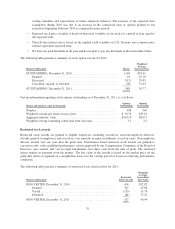

Included in income tax expense from discontinued operations in 2011 was $4.1 million related to the estimated

current value of a worthless stock deduction taken in 2009 in connection with our divestiture of the

Entertainment Business, which was sold in the third quarter of 2009.

62