Redbox 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• imposition of restrictive covenants and increased debt service obligations that provide us less flexibility

in how we operate our business to the extent we borrow to finance an acquisition;

• amortization expenses related to acquired intangible assets and other adverse accounting consequences;

• costs incurred in identifying and performing due diligence on potential targets and negotiating

agreements that may or may not be successful, including payment of break-up fees if transactions are

not closed (such as may be the case in the NCR asset acquisition if the transaction does not receive

applicable governmental anti-trust approval);

• impairment of relationships with employees, retailers and affiliates of our business and the acquired

business;

• entrance into markets in which we have no direct prior experience, such as the digital market through

our joint venture with Verizon; and

• impairment of goodwill and acquired intangible assets arising from our arrangements and investments.

Our stock price has been, and may continue to be, volatile.

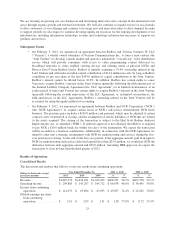

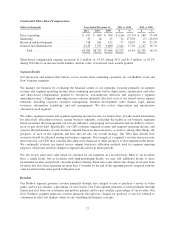

Our stock price has fluctuated substantially since our initial public offering in July 1997. For example, during the

year ended December 31, 2011, the closing price of our common stock ranged from $37.43 to $60.71 per share.

Our stock price may fluctuate significantly in response to a number of factors, including:

• the termination, non-renewal or re-negotiation of one or more retailer, supplier, distributor, or other

third-party relationships;

• trends and fluctuations in the use of our Redbox and Coin businesses;

• operating results below market expectations and changes in, or our failure to meet, financial estimates

of securities analysts or our own guidance;

• acquisition, merger, investment and disposition activities;

• period-to-period fluctuations in our financial results;

• announcements of technological innovations or new products or services by us or our competitors;

• announcements regarding the establishment, modification or termination of relationships regarding the

development of new or enhanced products and services;

• release of analyst reports;

• economic or other external factors, for example, those relating to the current economic environment

and fluctuations in the trading price of stocks generally;

• ineffective internal controls; and

• industry developments.

In addition, the securities markets have experienced significant price and volume fluctuations that are unrelated

to the operating performance of particular companies. These market fluctuations may also seriously harm the

market price of our common stock.

Our anti-takeover mechanisms may affect the price of our common stock and make it harder for a third

party to acquire us without the consent of our board of directors.

We have implemented anti-takeover provisions that may discourage takeover attempts and depress the market

price of our stock. Provisions in our certificate of incorporation and bylaws could make it more difficult for a

third party to acquire us, even if doing so would be beneficial to our stockholders. Delaware law also imposes

17