Redbox 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

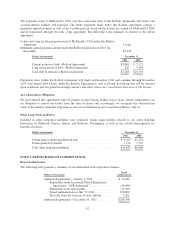

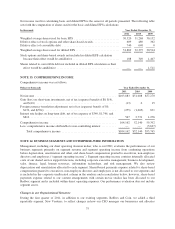

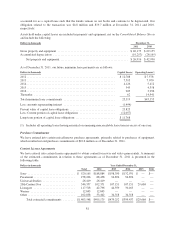

Deferred Tax Assets Relating to Income Tax Loss Carryforwards

Our deferred tax assets relating to income tax loss carryforwards and expiration periods are summarized as

below:

Dollars in thousands December 31, 2011

Federal State

Net operating loss carryforwards ......................... $ 217,672 $ 178,098

Deferred tax assets related to net operating loss

carryforwards ...................................... $ 76,185 $ 5,934

Years that net operating loss carryforwards will expire

between .......................................... 2024 and 2030 2016 and 2030

Based upon our projections for future taxable income over the periods in which the deferred tax assets are

deductible, we believe it is more likely than not that we will realize the benefits of these deductible differences,

net of the existing valuation allowances at December 31, 2011.

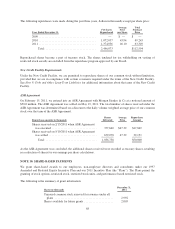

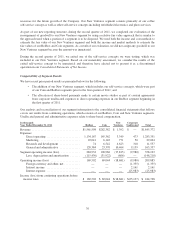

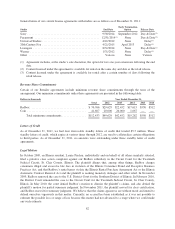

U.S. Federal Tax Credits and Expiration Periods

The following is the information pertaining to our U.S. federal tax credits as well as the expiration periods:

Dollars in thousands December 31, 2011

Amount Expiration

U.S Federal tax credits:

Foreign tax credits ......................................... $2,092 2014 to 2021

Research and development tax credits .......................... 3,355 2012 to 2026

Other general business tax credits ............................. 197 2027

Alternative minimum tax credits .............................. 728 Donotexpire

Total U.S. Federal tax credits ............................. $6,372

We did not provide for U.S. income taxes on undistributed earnings of foreign operations because they were

considered permanently invested outside of the U.S. Upon repatriation, some of these earnings would generate

foreign tax credits, which may reduce the U.S. tax liability associated with any future foreign dividend. At

December 31, 2011, the cumulative amount of earnings upon which U.S. income taxes have not been provided

was approximately $12.6 million.

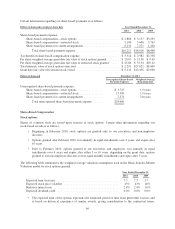

Income Tax Benefit from Stock Option Exercises

The income tax benefit realized from stock option exercises in excess of the amounts recognized in the

Consolidated Statements of Net Income were as follows:

Dollars in thousands Year Ended December 31,

2011 2010 2009

Excess income tax benefit from stock options exercised .............. $2,548 $6,770 $—

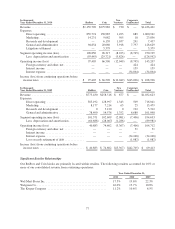

NOTE 12: EARNINGS PER SHARE

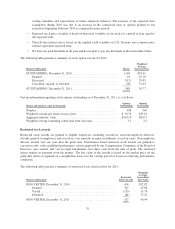

Basic earnings per share (“EPS”) is computed by dividing the net income for the period by the weighted average

number of common shares outstanding during the period. Diluted EPS is computed by dividing the net income

for the period by the weighted average number of common and dilutive potential common shares outstanding

during the period.

74