Redbox 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

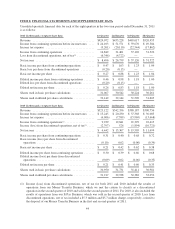

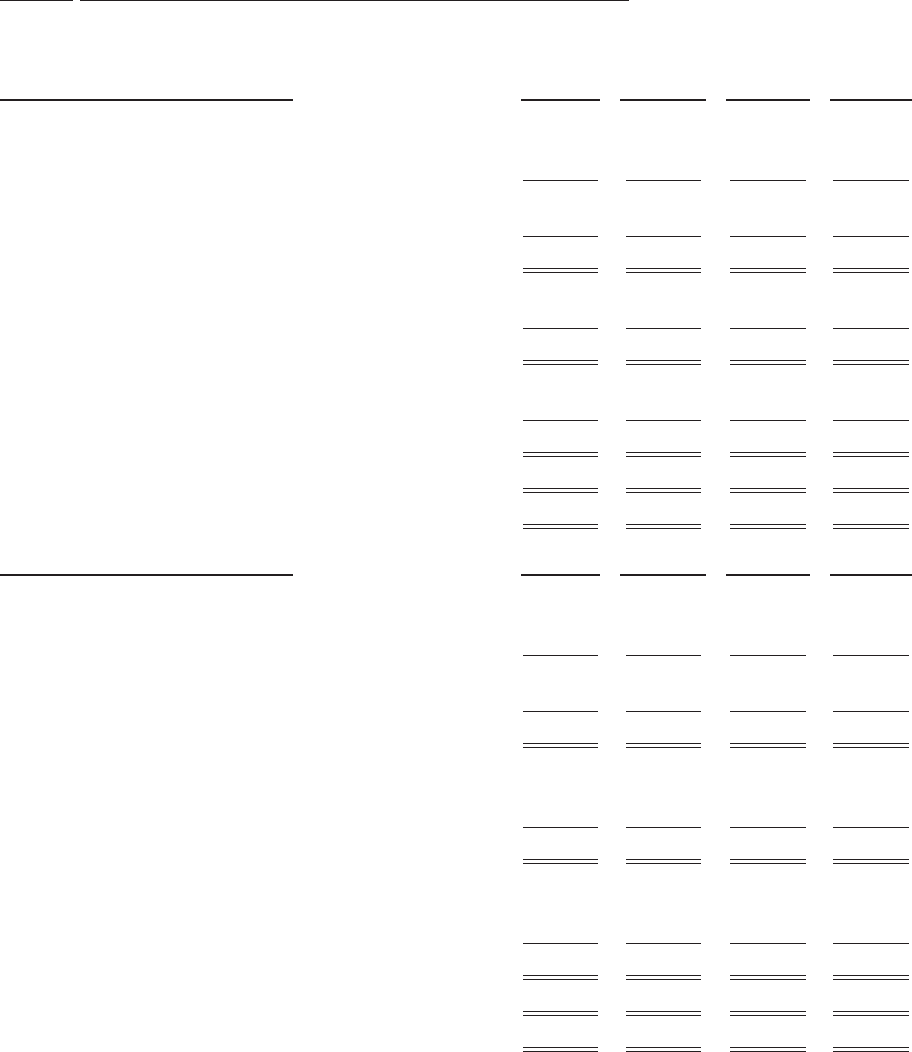

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Unaudited quarterly financial data for each of the eight quarters in the two-year period ended December 31, 2011

is as follows:

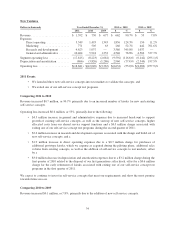

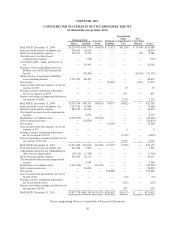

2011 (In thousands, except per share data) 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Revenue .......................................... $424,072 $435,228 $465,617 $520,455

Income from continuing operations before income taxes .... $ 24,103 $ 51,571 $ 59,670 $ 49,384

Income tax expense ................................. (9,261) (20,110) (22,544) (17,862)

Income from continuing operations ..................... 14,842 31,461 37,126 31,522

Loss from discontinued operations, net of tax(1) ............ (6,346) (4,722) — —

Net income ........................................ $ 8,496 $ 26,739 $ 37,126 $ 31,522

Basic income per share from continuing operations ........ $ 0.47 $ 1.03 $ 1.23 $ 1.04

Basic loss per share from discontinued operations ......... (0.20) (0.15) — —

Basic net income per share ............................ $ 0.27 $ 0.88 $ 1.23 $ 1.04

Diluted income per share from continuing operations ....... $ 0.46 $ 0.98 $ 1.18 $ 1.00

Diluted loss per share from discontinued operations ........ (0.20) (0.15) — —

Diluted net income per share .......................... $ 0.26 $ 0.83 $ 1.18 $ 1.00

Shares used in basic per share calculations ............... 31,067 30,542 30,224 30,261

Shares used in diluted per share calculations .............. 32,142 32,144 31,596 31,605

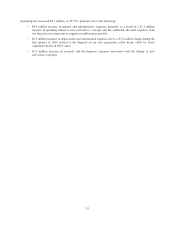

2010 (In thousands, except per share data) 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Revenue .......................................... $323,122 $342,356 $380,187 $390,756

Income from continuing operations before income taxes .... $ 15,245 $ 20,230 $ 37,368 $ 36,083

Income tax expense ................................. (6,006) (7,389) (15,969) (13,668)

Income from continuing operations(2) .................... 9,239 12,841 21,399 22,415

Income (loss) from discontinued operations, net of tax(1) ..... (2,797) 526 (1,894) (10,721)

Net income ........................................ $ 6,442 $ 13,367 $ 19,505 $ 11,694

Basic income per share from continuing operations ........ $ 0.31 $ 0.40 $ 0.68 $ 0.72

Basic income (loss) per share from discontinued

operations ....................................... (0.10) 0.02 (0.06) (0.34)

Basic net income per share ............................ $ 0.21 $ 0.42 $ 0.62 $ 0.38

Diluted income per share from continuing operations ....... $ 0.30 $ 0.39 $ 0.66 $ 0.68

Diluted income (loss) per share from discontinued

operations ....................................... (0.09) 0.02 (0.06) (0.33)

Diluted net income per share .......................... $ 0.21 $ 0.41 $ 0.60 $ 0.35

Shares used in basic per share calculations ............... 30,950 31,731 31,411 30,981

Shares used in diluted per share calculations .............. 31,217 32,938 32,382 33,052

(1) Income (loss) from discontinued operations, net of tax for both 2011 and 2010 included the results of

operations from our Money Transfer Business, which we met the criteria to classify as a discontinued

operation in the second quarter of 2010 and sold in the second quarter of 2011. For 2010, it also included the

results of operations from our E-Pay Business, which was sold in the second quarter of 2010. Loss from

discontinued operations, net of tax included a $5.3 million and $5.7 million charge, respectively, related to

the disposal of our Money Transfer Business in the first and second quarters of 2011.

44