Redbox 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

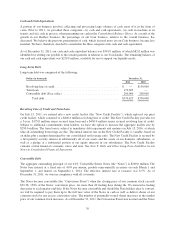

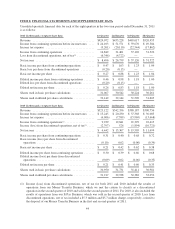

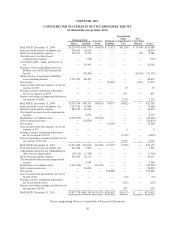

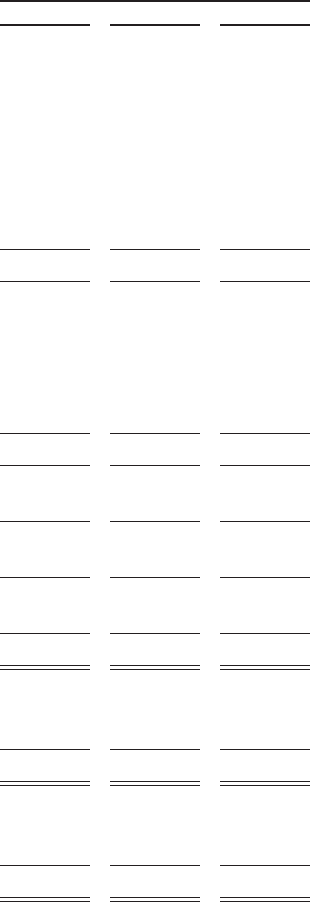

COINSTAR, INC.

CONSOLIDATED STATEMENTS OF NET INCOME

(in thousands, except per share data)

Year Ended December 31,

2011 2010 2009

Revenue .................................................. $1,845,372 $1,436,421 $1,032,623

Expenses:

Direct operating(1) ....................................... 1,283,351 1,000,941 716,041

Marketing ............................................. 29,004 23,836 15,479

Research and development ................................ 11,557 7,437 5,312

General and administrative ............................... 163,357 128,629 101,098

Depreciation and other (2) ................................. 145,478 123,687 86,418

Amortization of intangible assets ........................... 2,740 3,305 3,563

Litigation settlement ..................................... — 5,379 —

Total expenses ............................................. 1,635,487 1,293,214 927,911

Operating income ........................................... 209,885 143,207 104,712

Other income (expense):

Foreign currency and other, net ............................ (1,335) 424 31

Interest income ......................................... 2,161 159 —

Interest expense ........................................ (25,983) (34,864) (34,248)

Early retirement of debt .................................. — — (1,082)

Total other income (expense) .................................. (25,157) (34,281) (35,299)

Income from continuing operations before income taxes ............ 184,728 108,926 69,413

Income tax expense ......................................... (69,777) (43,032) (25,720)

Income from continuing operations ............................. 114,951 65,894 43,693

Income (loss) from discontinued operations, net of tax .............. (11,068) (14,886) 13,577

Net income ................................................ 103,883 51,008 57,270

Net income attributable to non-controlling interests ................ — — (3,627)

Net income attributable to Coinstar, Inc. ......................... $ 103,883 $ 51,008 $ 53,643

Basic earnings (loss) per share attributable to Coinstar, Inc.:

Continuing operations ................................... $ 3.76 $ 2.11 $ 1.33

Discontinued operations .................................. (0.36) (0.48) 0.45

Basic earnings per share attributable to Coinstar, Inc. ............... $ 3.40 $ 1.63 $ 1.78

Diluted earnings (loss) per share attributable to Coinstar, Inc.:

Continuing operations ................................... $ 3.61 $ 2.03 $ 1.31

Discontinued operations .................................. (0.35) (0.46) 0.45

Diluted earnings per share attributable to Coinstar, Inc. ............. $ 3.26 $ 1.57 $ 1.76

Weighted average shares used in basic per share calculations ........ 30,520 31,268 30,152

Weighted average shares used in diluted per share calculations ....... 31,869 32,397 30,514

(1) “Direct operating” excludes depreciation and other of $121.2 million, $110.0 million, and $78.6 million for

2011, 2010, and 2009 respectively.

(2) “Depreciation and other” includes the write-down and acceleration of depreciation for certain revenue

generating kiosks in the amount of $9.5 million in 2010.

See accompanying Notes to Consolidated Financial Statements

49