Redbox 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

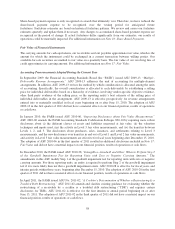

In September 2011, the FASB issued ASU No. 2011-08, “Testing Goodwill for Impairment.” ASU 2011-08

simplifies the goodwill impairment assessment by permitting a company to make a qualitative assessment of

whether it is more likely than not that a reporting unit’s fair value is less than its carrying amount before applying

the two-step goodwill impairment test. If the conclusion is that it is more likely than not that the fair value of a

reporting unit is less than its carrying amount, the company would be required to conduct the current two-step

goodwill impairment test. Otherwise, it would not need to apply the two-step test. ASU 2011-08 is effective for

annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011 and

early adoption is permitted. We adopted ASU 2011-08 in the fourth quarter of 2011 in connection with our

goodwill impairment assessment and it did not have a material impact on our financial position, results of

operations, or cash flows.

Accounting Pronouncements Not Yet Effective

In May 2011, the FASB issued ASU No. 2011-04, “Amendments to Achieve Common Fair Value Measurement

and Disclosure Requirements in U.S. GAAP and IFRS.” ASU 2011-04 was issued to achieve common fair value

measurement and disclosure requirements between U.S. GAAP and International Financial Reporting Standards.

ASU 2011-04 amends current fair value measurement and disclosure guidance to include increased transparency

around valuation inputs and investment categorization. ASU 2011-04 is effective for fiscal years and interim

periods beginning after December 15, 2011. We do not believe our adoption of ASU 2011-04 in the first quarter

of 2012 will have a material impact on our financial position, results of operations or cash flows.

In June 2011, the FASB issued ASU No. 2011-05, “Presentation of Comprehensive Income.” ASU 2011-05

allows an entity to have the option to present the components of net income and comprehensive income in either

one or two consecutive financial statements. ASU 2011-05 eliminates the current option to report other

comprehensive income and its components in the statement of changes in equity. While the new guidance

changes the presentation of comprehensive income, there are no changes to the components that are recognized

in net income or other comprehensive income under current accounting guidance. ASU 2011-05 is effective for

fiscal years and interim periods beginning after December 15, 2011. In November 2011, the Board decided to

defer the effective date of certain changes related to the presentation of reclassification adjustments. A final

effective date for those changes is expected to be issued soon. While ASU 2011-05 will require us to change the

manner in which we present other comprehensive income and its components on a retrospective basis, we do not

believe our adoption of ASU 2011-05 in the first quarter of 2012 will have a material impact on our financial

position, results of operations or cash flows.

Reclassifications

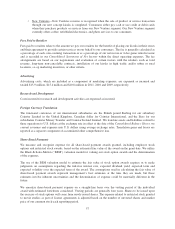

During the second quarter of 2011, we consolidated our cash categories into one line item, cash and cash

equivalents, on our Consolidated Balance Sheets to better align with how we manage our company. This

reclassification had no effect on our consolidated financial position, results of operations, or cash flows.

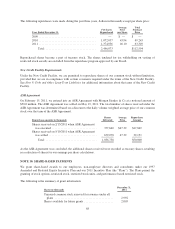

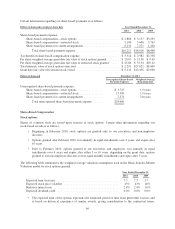

NOTE 3: BUSINESS COMBINATION

Redbox

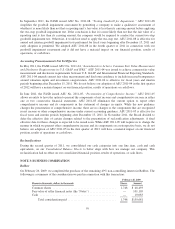

On February 26, 2009, we completed the purchase of the remaining 49% non-controlling interest in Redbox. The

following is a summary of the consideration we paid in connection with this transaction:

February 26, 2009

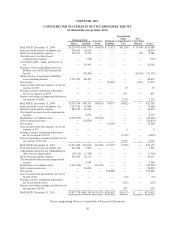

Shares in thousands, dollars in thousands Shares Amount

Common shares ........................................... 1,748 $ 48,493

Fair value of seller financed notes (the “Notes”) .................. — 101,105

Cash .................................................... — 10,083

Total consideration paid ................................. 1,748 $159,681

59