Redbox 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

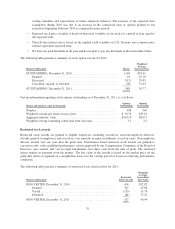

• Level 2: Inputs other than quoted prices that are observable for the asset or liability, either directly or

indirectly; these include quoted prices for similar assets or liabilities in active markets and quoted

prices for identical or similar assets or liabilities in markets that are not active; or

• Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions.

The factors or methodology used for valuing securities are not necessarily an indication of the risk associated

with investing in those securities.

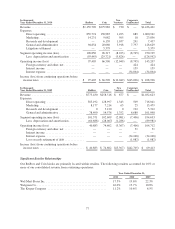

Assets and Liabilities Measured and Reported at Fair Value on a Recurring Basis

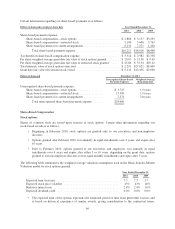

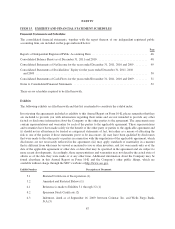

The following table presents our financial assets and (liabilities) that are measured and reported at fair value in

our Consolidated Balance Sheets on a recurring basis, by level within the fair value hierarchy (in thousands):

Fair Value at December 31, 2011 Level 1 Level 2 Level 3

Money market funds and certificates of deposit .................. $45,363 $ — $ —

Fair Value at December 31, 2010 Level 1 Level 2 Level 3

Money market funds and certificates of deposit .................. $41,598 $ — $ —

Interest rate swap liability ................................... $ — $(896) $ —

Assets held for sale, net of liabilities held for sale ................ $ — $— $43,634

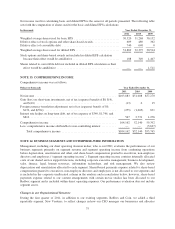

Money Market Funds and Certificates of Deposit

We determine fair value for our money market funds and certificates of deposit based on quoted market prices.

The fair value of these assets is included in cash and cash equivalents on our Consolidated Balance Sheets.

Interest Rate Swap Liability

We used a market valuation approach to value our interest rate swap derivative contracts using current market

information as of the reporting date, such as the forecast of future market interest rates and implied volatility. We

mitigated derivative credit risk by transacting with highly rated counterparties. Our interest rate swap agreement

for our old credit facility expired in 2011.

Assets Held For Sale

We used a market valuation approach to estimate the fair value of the Money Transfer Business, which we sold

to Sigue in 2011. The estimated fair value of assets held for sale in the table above excluded the costs to sell of

$2.0 million.

There were no changes to our valuation techniques in 2011.

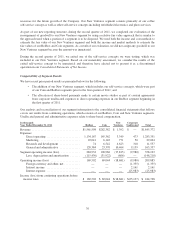

Assets and Liabilities Measured and Reported at Fair Value on a Nonrecurring Basis

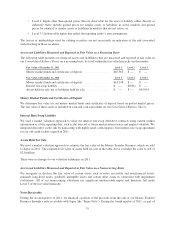

We recognize or disclose the fair value of certain assets such as notes receivable and non-financial assets,

primarily long-lived assets, goodwill, intangible assets and certain other assets in connection with impairment

evaluations. All of our nonrecurring valuations use significant unobservable inputs and therefore fall under

Level 3 of the fair value hierarchy.

Notes Receivable

During the second quarter of 2011, we financed a portion of the proceeds from the sale of our Money Transfer

Business through a note receivable with Sigue (the “Sigue Note”). During the fourth quarter of 2011, as part of

79