Redbox 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We are focusing on growing our core businesses and developing innovative new concepts in the automated retail

space through organic growth and external investment. We will also continue to expand our use of social media

to drive awareness of our offerings and continue to leverage new and innovative ideas to drive demand. In order

to support growth, we also expect to continue devoting significant resources for the ongoing development of our

infrastructure, including information technology systems and technology infrastructure necessary to support our

products and services.

Subsequent Events

• On February 3, 2012, we announced an agreement between Redbox and Verizon Ventures IV LLC

(“Verizon”), a wholly owned subsidiary of Verizon Communications Inc., to form a joint venture (the

“Joint Venture”) to develop, launch, market and operate a nationwide “over-the-top” video distribution

service which will provide consumers with access to video programming content delivered via

broadband networks to video enabled viewing devices and offering rental of physical DVDs and

Blu-ray Discs®from Redbox kiosks. Redbox is initially acquiring a 35.0% ownership interest in the

Joint Venture and will make an initial capital contribution of $14.0 million in cash. So long as Redbox

contributes its pro rata share of the first $450.0 million of capital contributions to the Joint Venture,

Redbox’s interest cannot be diluted below 10.0%. In addition, Redbox has certain rights to cause

Verizon to acquire Redbox’s interest in the Joint Venture (generally following the fifth anniversary of

the Limited Liability Company Agreement (the “LLC Agreement”) or in limited circumstances, at an

earlier period of time) and Verizon has certain rights to acquire Redbox’s interest in the Joint Venture

(generally following the seventh anniversary of the LLC Agreement, or, in limited circumstances, the

fifth anniversary of the LLC Agreement). Redbox’s ownership interest in the Joint Venture will be

accounted for using the equity method of accounting.

• On February 3, 2012, we announced an agreement between Redbox and NCR Corporation (“NCR”)

(the “NCR Agreement”), to acquire certain assets of NCR’s self-service entertainment DVD kiosk

business. The purchase price includes a $100.0 million cash payment, which may be adjusted if certain

contracts aren’t transferred at closing, and the assumption of certain liabilities of NCR that are related

to the assets acquired. The closing of the transaction is subject to the Hart Scott Rodino Antitrust

Improvements Act, as amended (“HSR”). If antitrust approval is not obtained, then Rebox is required

to pay NCR a $10.0 million break fee within five days of the termination. We expect the transaction

will be recorded as a business combination. Additionally, in connection with the NCR Agreement, we

intend to enter into a strategic arrangement with NCR for manufacturing and services during the five-

year period post-closing. At the end of the five-year period, if the aggregate amount paid in margin to

NCR for manufacturing and services delivered equaled less than $25.0 million, we would pay NCR the

difference between such aggregate amount and $25.0 million. Assuming HSR approval, we expect the

transaction to close no later than the third quarter of 2012.

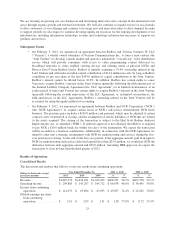

Results of Operations

Consolidated Results

The discussion and analysis that follows covers our results from continuing operations.

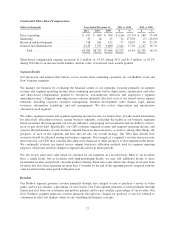

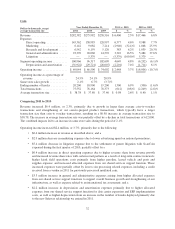

Dollars in thousands, except

per share amounts

Year Ended December 31, 2011 vs. 2010 2010 vs. 2009

2011 2010 2009 $ % $ %

Revenue ................. $1,845,372 $1,436,421 $1,032,623 $408,951 28.5% $403,798 39.1%

Operating income ......... $ 209,885 $ 143,207 $ 104,712 $ 66,678 46.6% $ 38,495 36.8%

Income from continuing

operations ............. $ 114,951 $ 65,894 $ 43,693 $ 49,057 74.4% $ 22,201 50.8%

Diluted earnings per share

from continuing

operations ............. $ 3.61 $ 2.03 $ 1.31 $ 1.58 77.8% $ 0.72 55.0%

25