Redbox 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

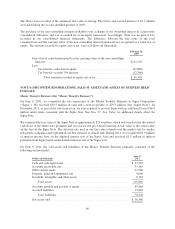

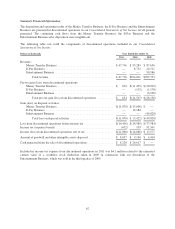

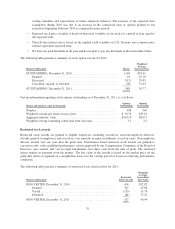

Other Intangible Assets

The gross amount of our other intangible assets and the related accumulated amortization were as follows:

Dollars in thousands Amortization

Period

December 31,

2011 2010

Retailer relationships ................................ 5and6years $13,344 $13,344

Accumulated amortization ............................ (7,062) (4,606)

6,282 8,738

Other ............................................. 5and40years 1,890 1,890

Accumulated amortization ............................ (1,339) (1,056)

551 834

Intangible assets, net ................................ $ 6,833 $ 9,572

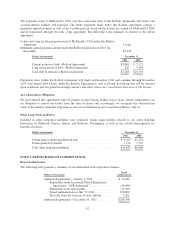

Amortization expense was as follows:

Dollars in thousands Year Ended December 31,

2011 2010 2009

Retailer relationships ........................................ $2,457 $3,022 $3,275

Other ..................................................... 283 283 288

Total amortization of intangible assets ...................... $2,740 $3,305 $3,563

Expected future amortization is as follows:

Dollars in thousands Relationships Other

2012 ................................................... $2,457 $ 81

2013 ................................................... 2,250 14

2014 ................................................... 1,432 14

2015 ................................................... 12 14

2016 ................................................... 12 14

Thereafter ............................................... 119 414

Total expected amortization ............................. $6,282 $551

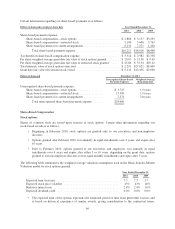

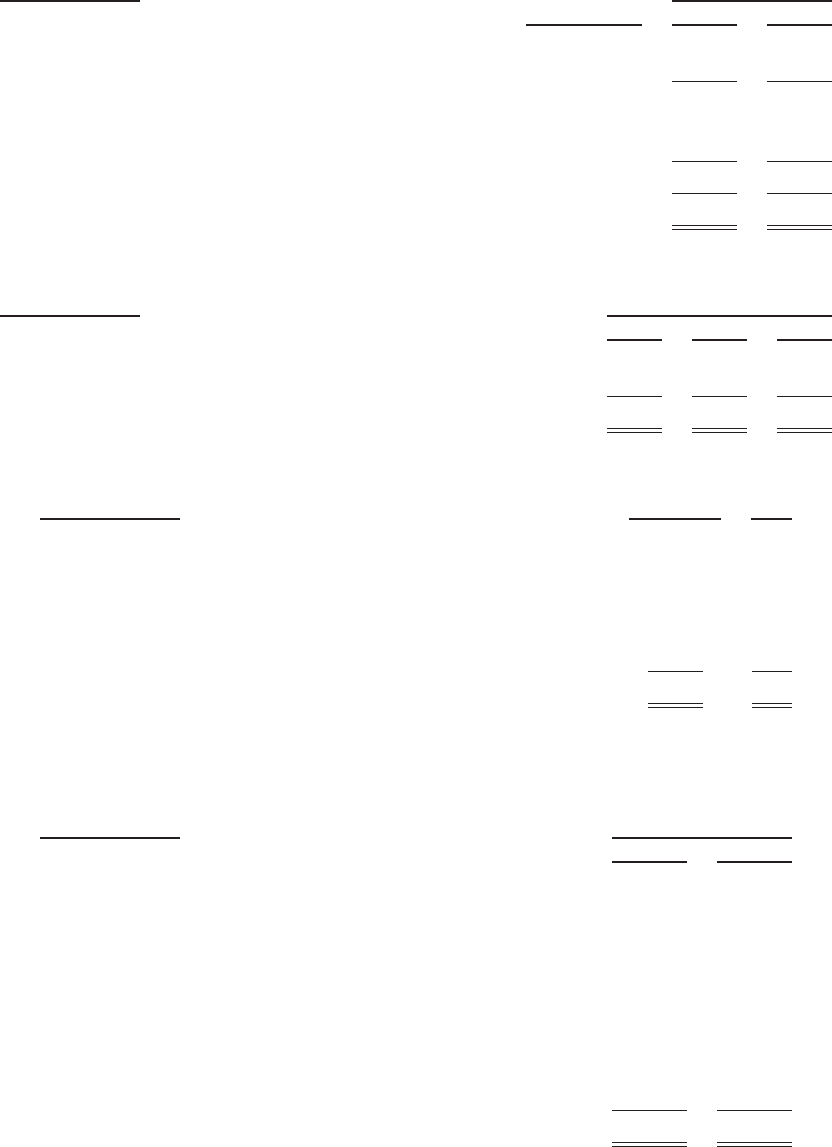

NOTE 7: OTHER ACCRUED LIABILITIES

Other accrued liabilities consist of the followings:

Dollars in thousands December 31,

2011 2010

Payroll related expenses .................................. $ 37,498 $ 29,931

Procurement cost for content library ......................... 36,031 21,801

Business taxes .......................................... 21,613 16,339

Interest expense ......................................... 6,192 5,901

Service contract provider expenses .......................... 6,525 5,365

Insurance .............................................. 4,172 5,172

Deferred rent expense .................................... 3,794 4,399

Income tax payable ...................................... 2,876 2,262

Professional fees ........................................ 4,816 2,176

Other ................................................. 25,479 15,076

Total other accrued liabilities .......................... $148,996 $108,422

64