Quest Diagnostics 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 27

for the respective jurisdiction. The Internal Revenue Service (“IRS”) has completed its examinations of the Company's

consolidated federal income tax returns up through and including the 2009 tax year; however, the Company is currently

appealing several proposed tax adjustments for its 2008 and 2009 tax years. At this time, the Company does not believe that

there will be any material additional payments beyond its recorded contingent liability reserves that may be required as a result

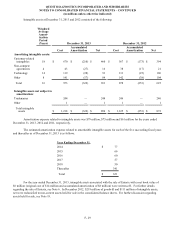

of these tax audits. As of December 31, 2013, a summary of the tax years that remain subject to examination, or that are under

appeal, for the Company's major jurisdictions are:

United States - federal 2008 - 2013

United States - various states 2005 - 2013

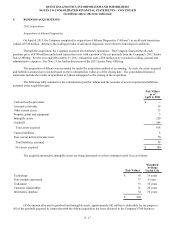

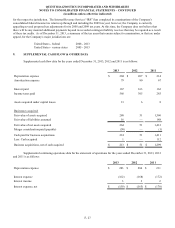

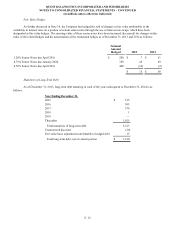

9. SUPPLEMENTAL CASH FLOW & OTHER DATA

Supplemental cash flow data for the years ended December 31, 2013, 2012 and 2011 is as follows:

2013 2012 2011

Depreciation expense $ 204 $ 207 $ 214

Amortization expense 79 80 67

Interest paid 167 163 162

Income taxes paid 568 305 285

Assets acquired under capital leases 13 6 8

Businesses acquired:

Fair value of assets acquired 280 51 1,560

Fair value of liabilities assumed 16 — 148

Fair value of net assets acquired 264 51 1,412

Merger consideration paid (payable) (50)— (1)

Cash paid for business acquisitions 214 51 1,411

Less: Cash acquired 1 — 112

Business acquisitions, net of cash acquired $ 213 $ 51 $ 1,299

Supplemental continuing operations data for the statement of operations for the years ended December 31, 2013, 2012

and 2011 is as follows:

2013 2012 2011

Depreciation expense $ 203 $ 204 $ 211

Interest expense (162)(168)(172)

Interest income 3 3 2

Interest expense, net $ (159)$ (165)$ (170)

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)