Quest Diagnostics 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

expenses associated with the acquired operations of Athena, Celera and S.E.D. Pre-tax restructuring and integration charges

totaled $106 million ($52 million in cost of services and $54 million in selling, general and administrative expenses) in 2012

and include $61 million of restructuring related costs discussed in more detail in Note 4 to the consolidated financial

statements. In addition, $10 million of pre-tax charges, associated with separation costs and accelerated vesting of certain

equity awards in connection with the succession of our prior CEO, were recorded in selling, general and administrative

expenses in 2012.

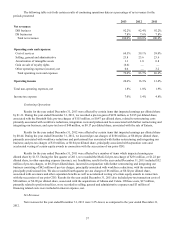

The decrease in total operating expenses as a percentage of net revenues compared to the prior year is principally due

to the Medi-Cal charge recorded in 2011.

Results for the year ended December 31, 2011 included the Medi-Cal pre-tax charge of $236 million recorded in

connection with the California Lawsuit. In addition, results for the year ended December 31, 2011 included $52 million of pre-

tax charges incurred in conjunction with further restructuring and integrating our business consisting of $42 million of pre-tax

charges, principally associated with workforce reductions, with the remainder principally professional fees. Of these costs, $22

million and $30 million were included in cost of services and selling, general and administrative expenses, respectively. In

addition, $6 million of pre-tax charges, associated with severance and other separation benefits as well as accelerated vesting of

certain equity awards in connection with the succession of our prior CEO, were recorded in selling, general and administrative

expenses in the fourth quarter of 2011. Selling, general and administrative expenses for the year ended December 31, 2011 also

included $17 million of pre-tax transaction costs, primarily related to professional fees associated with the acquisitions of

Athena and Celera.

Cost of Services

Cost of services consists principally of costs for obtaining, transporting and testing specimens.

The decrease in cost of services for the year ended December 31, 2013, as compared to the year ended December 31,

2012, is primarily due to the impact of actions we have taken to reduce our cost structure under the Invigorate program and

lower performance-based compensation, partially offset by increased costs related to our recent acquisitions.

The increase in cost of services as a percentage of net revenues for the year ended December 31, 2013, as compared to

the year ended December 31, 2012, was primarily related to the decrease in net revenues in 2013.

Cost of services as a percentage of revenues for the year ended December 31, 2012 was essentially unchanged, as

compared to the year ended December 31, 2011. Restructuring and integration activities and higher costs associated with

employee compensation and benefits, which served to increase the percentage, were offset by actions we took to reduce our

cost structure under our Invigorate program.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist principally of the costs associated with our sales and marketing

efforts, billing operations, bad debt expense and general management and administrative support.

The decrease in selling, general and administrative expenses for the year ended December 31, 2013 is primarily due to

the impact of actions we have taken to reduce our cost structure under the Invigorate program and lower performance-based

compensation. This was partially offset by higher charges associated with restructuring and integration activities for the year

ended December 31, 2013, as compared to the year ended December 31, 2012,

The increase in selling, general and administrative expenses as a percentage of net revenues for the year ended

December 31, 2013, as compared to the year ended December 31, 2012, was primarily related to the decrease in net revenues in

2013.

Selling, general and administrative expenses as a percentage of net revenues for the year ended December 31, 2012

was essentially unchanged, as compared to the year ended December 31, 2011. Restructuring and integration activities,

investments we made in our commercial sales organization, costs incurred in connection with the succession of our prior CEO

and higher costs associated with employee compensation and benefits served to increase the percentage compared to the prior

year. This was offset by actions we took to reduce our cost structure under our Invigorate program and transaction costs

associated with the Athena and Celera acquisitions that were incurred during the 2011.