Quest Diagnostics 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 32

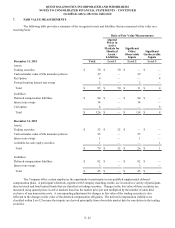

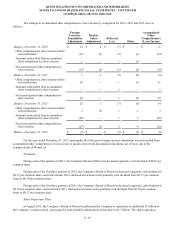

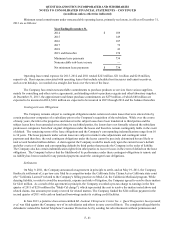

Fair Value Hedges

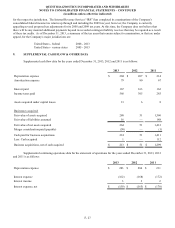

As further discussed in Note 14, the Company has hedged the risk of changes in fair value attributable to the

variability in interest rates on a portion of certain senior notes through the use of interest rate swaps, which have been

designated as fair value hedges. The carrying value of these senior notes have been increased (decreased) for changes in fair

value of the related hedges and the amortization of the terminated hedges as of December 31, 2013 and 2012 as follows:

Notional

Amount

Hedged 2013 2012

3.20% Senior Notes due April 2016 $ 200 $ 7 $ 11

4.75% Senior Notes due January 2020 350 24 49

4.70% Senior Notes due April 2021 400 (16)(2)

$15$58

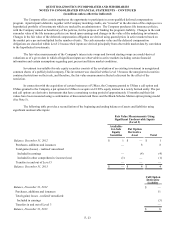

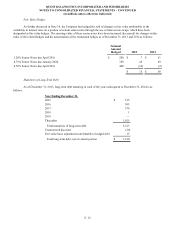

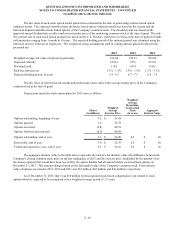

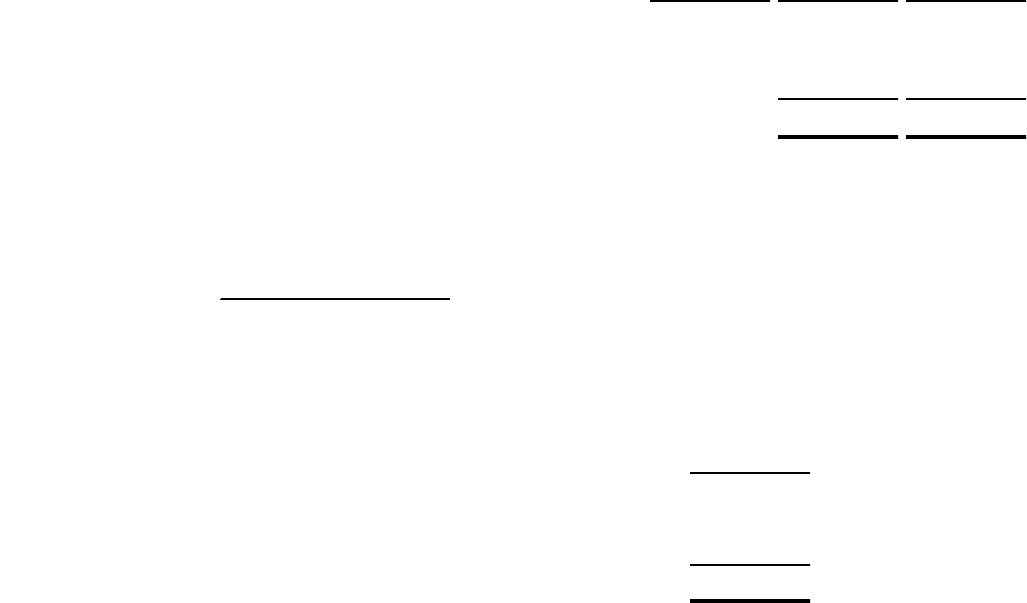

Maturities of Long-Term Debt

As of December 31, 2013, long-term debt maturing in each of the years subsequent to December 31, 2014 is as

follows:

Year Ending December 31,

2015 $ 515

2016 305

2017 379

2018 1

2019 —

Thereafter 1,925

Total maturities of long-term debt 3,125

Unamortized discount (20)

Fair value basis adjustments attributable to hedged debt 15

Total long-term debt, net of current portion $ 3,120

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)