Quest Diagnostics 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 41

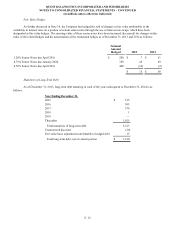

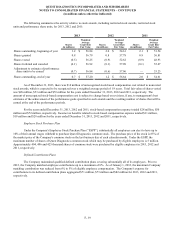

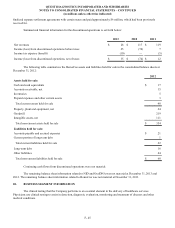

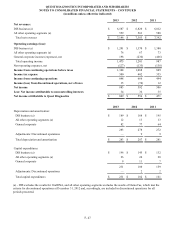

Minimum rental commitments under noncancelable operating leases, primarily real estate, in effect at December 31,

2013 are as follows:

Year Ending December 31,

2014 $ 189

2015 149

2016 107

2017 72

2018 43

2019 and thereafter 174

Minimum lease payments 734

Noncancelable sub-lease income —

Net minimum lease payments $ 734

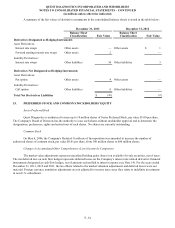

Operating lease rental expense for 2013, 2012 and 2011 totaled $223 million, $211 million and $218 million,

respectively. Rent expense associated with operating leases that include scheduled rent increases and tenant incentives,

such as rent holidays, is recorded on a straight-line basis over the term of the lease.

The Company has certain noncancelable commitments to purchase products or services from various suppliers,

mainly for consulting and other service agreements, and standing orders to purchase reagents and other laboratory supplies.

At December 31, 2013, the approximate total future purchase commitments are $279 million, of which $88 million are

expected to be incurred in 2014, $110 million are expected to be incurred in 2015 through 2016 and the balance thereafter.

Contingent Lease Obligations

The Company remains subject to contingent obligations under certain real estate leases that were entered into by

certain predecessor companies of a subsidiary prior to the Company's acquisition of the subsidiary. While over the course

of many years, the title to the properties and interest in the subject leases have been transferred to third parties and the

subject leases have been amended several times by such third parties, the lessors have not formally released the subsidiary

predecessor companies from their original obligations under the leases and therefore remain contingently liable in the event

of default. The remaining terms of the lease obligations and the Company's corresponding indemnifications range from 10

to 34 years. The lease payments under certain leases are subject to market value adjustments and contingent rental

payments and therefore, the total contingent obligations under the leases cannot be precisely determined but are likely to

total several hundred million dollars. A claim against the Company would be made only upon the current lessee's default

and after a series of claims and corresponding defaults by third parties that precede the Company in the order of liability.

The Company also has certain indemnification rights from other parties to recover losses in the event of default on the lease

obligations. The Company believes that the likelihood of its performance under these contingent obligations is remote and

no liability has been recorded for any potential payments under the contingent lease obligations.

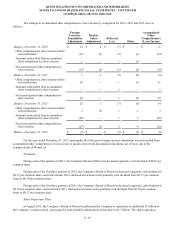

Settlements

On May 9, 2011, the Company announced an agreement in principle to settle, and on May 19, 2011, the Company

finalized a settlement of, a qui tam case filed by a competitor under the California False Claims Act in California state court

(the "California Lawsuit") related to the Company's billing practices to Medi-Cal, the California Medicaid program. While

denying liability, in order to avoid the uncertainty, expense and risks of litigation, the Company agreed to resolve these matters

for $241 million. As a result of the agreement in principle, the Company recorded a pre-tax charge to earnings in the first

quarter of 2011 of $236 million (the "Medi-Cal charge"), which represented the cost to resolve the matters noted above and

related claims, less amounts previously reserved for related matters. The Company funded the $241 million payment in the

second quarter of 2011 with cash on hand and borrowings under its existing credit facilities.

In June 2013, a putative class action entitled Mt. Lookout Chiropractic Center Inc. v. Quest Diagnostics Incorporated,

et al. was filed against the Company, two of its subsidiaries and others in state court in Illinois. The complaint alleged that the

defendants violated the federal Telephone Consumer Protection Act by sending fax advertisements without permission and

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)