Quest Diagnostics 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

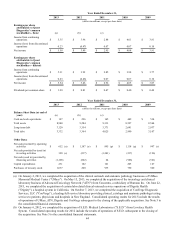

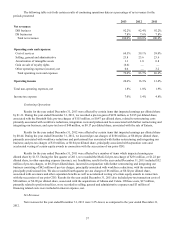

Our high-level estimated pre-tax charges expected to be incurred through 2014 have been updated in connection with

our Invigorate program range from $230 million to $290 million and consist of $145 million to $165 million of employee

separation costs; $35 million to $45 million of facility-related costs; $5 million to $15 million of asset impairment charges; and

$45 million to $65 million of systems conversion and integration costs. Of the total estimated pre-tax charges expected to be

incurred, we estimate that $225 million to $275 million are anticipated to result in cash expenditures. The actual charges

incurred in connection with the multi-year course of action could be materially different from these estimates. As detailed plans

to implement the multi-year course of action are approved and executed, it will result in charges to earnings. Through

December 31, 2013, the cumulative charge recorded in connection with the Invigorate program was approximately $183

million.

For additional information on the Invigorate program and associated restructuring related costs, see Note 4 to the

consolidated financial statements.

Outlook and Trends

The broad decline of healthcare utilization seen in 2013 is expected to continue in 2014. We are expecting a limited

but positive impact from the Affordable Care Act ("ACA") due to the delay of the employer mandate, a reduction in the number

of states that have decided to expand their Medicaid programs, and initial challenges related to the implementation of the

insurance exchanges. Additionally, we continue to see an increase in the amount of cost sharing deployed through benefit

design changes, which will put pressure on utilization. As a result, we believe the ACA will be neutral to slightly positive in

2014; but we still expect to see a bigger benefit over the long run beyond 2014. We expect that reimbursement will continue to

decline 1-2% per year through 2015. This is due in part to the physician fee schedule reduction in January 2013 by CMS and

the 0.75% reduction to the clinical laboratory fee schedule by CMS in January 2014.

We continue to believe that the industry will benefit from continued population growth and favorable demographics as

baby boomers move into Medicare and live longer; esoteric testing will continue to grow as precision medicine drives demand

for advanced esoteric tests; and more insured lives will gradually begin to enter the market each year under the ACA. Over the

long term, we see significant opportunity in being a high quality, low cost provider of diagnostic information services, which

are essential to healthcare delivery.

We remain committed to executing our five-point strategy and our top priority for 2014 is to restore growth. Our near-

term investments in growth are likely to also include value-creating accretive acquisitions. Our recently announced agreement

to acquire Solstas Lab Partners Group and its subsidiaries ("Solstas"), a full-service commercial laboratory based in

Greensboro, North Carolina, is an example of this, and would strengthen our lab professional services organization.

Additionally, we will continue to invest in science and innovation in the form of licensing, collaborations and internal

development to grow esoteric testing and tools to support commercial excellence.

Reimbursement for Services

Payments for diagnostic testing services are made by physicians, hospitals, employers, healthcare insurers, patients

and governmental authorities. Physicians, hospitals and employers are typically billed on a fee-for-service basis based on

negotiated fee schedules. Fees billed to healthcare insurers and patients are based on the laboratory's patient fee schedule,

subject to any limitations on fees negotiated with the healthcare insurers or with physicians on behalf of their patients.

Medicare and Medicaid reimbursements are based on fee schedules set by governmental authorities. Government payers, such

as Medicare and Medicaid, as well as healthcare insurers and larger employers, have taken steps and may continue to take steps

to control the cost, utilization and delivery of healthcare services, including diagnostic testing services.

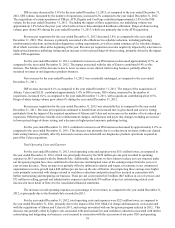

Part B of the Medicare program contains fee schedule payment methodologies for clinical testing services performed

for covered patients, including a national ceiling on the amount that carriers could pay under their local Medicare clinical

testing fee schedules. The Medicare Clinical Laboratory Fee Schedule for 2014 is decreased by 0.75% from 2013 levels. In

addition, reimbursement under the Medicare Clinical Laboratory Fee Schedule continues to be reduced by 2% as a result of

federal government sequestration. CMS implemented changes in the Medicare Physician Fee Schedule effective January 1,

2014 that are expected to reduce reimbursement for tissue biopsy, immunohistochemistry and other services. In December

2013, Congress delayed by three months a potential decrease of approximately 24% in the Medicare Physician Fee Schedule

that otherwise would have become effective on January 1, 2014. In 2013, approximately 12% of our consolidated revenues

were reimbursed by Medicare under the Clinical Laboratory Fee Schedule and approximately 2% were reimbursed by

Medicare under the Physician Fee Schedule.