Quest Diagnostics 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

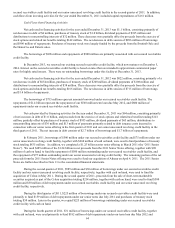

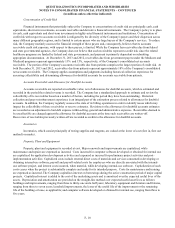

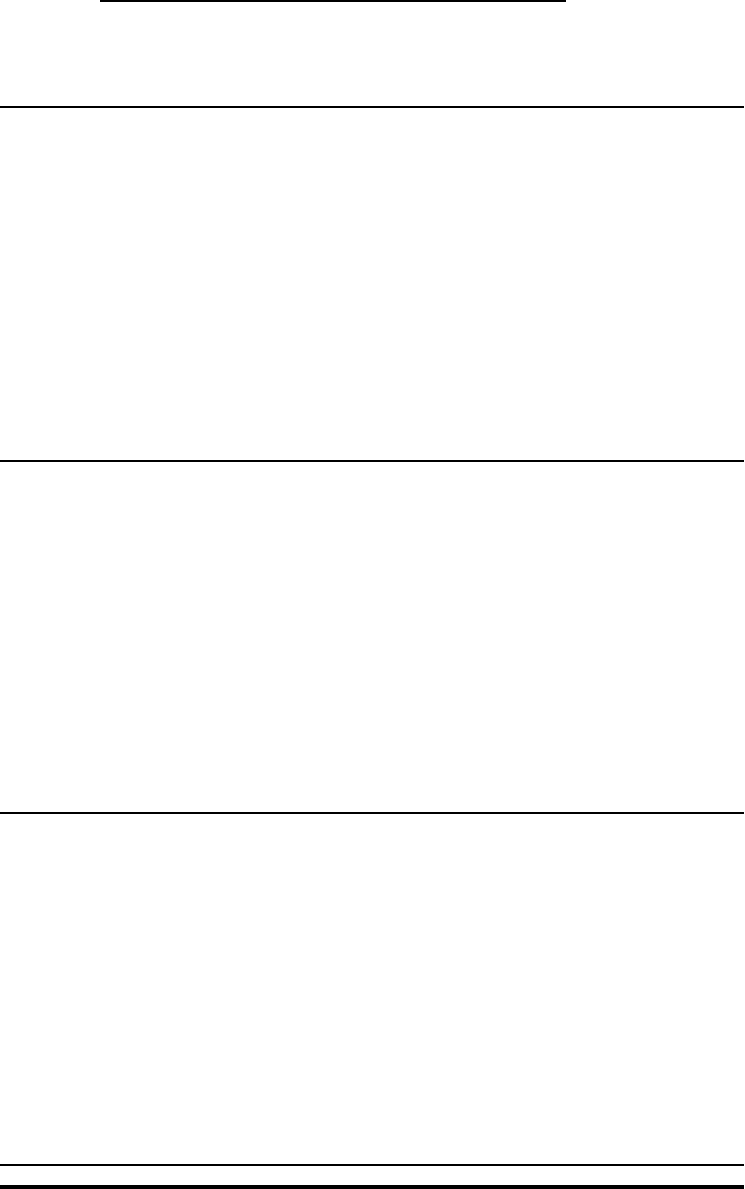

F- 6

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2013, 2012 AND 2011

(in millions)

Quest Diagnostics Stockholders’ Equity

Shares of

Common

Stock

Outstanding

Common

Stock

Additional

Paid-In

Capital

Retained

Earnings

Accumulated

Other

Compre-

hensive

(Loss)

Income

Treasury

Stock, at

Cost

Non-

controlling

Interests

Total

Stock-

holders’

Equity

Balance, December 31, 2010 171 $ 2 $ 2,311 $ 3,867 $ 11 $ (2,158) $ 21 $ 4,054

Net income 471 35 506

Other comprehensive loss, net of tax (19) (19)

Dividends declared (74) (74)

Distributions to noncontrolling interests (36) (36)

Issuance of common stock under benefit

plans 1 2 18 20

Stock-based compensation expense 68 4 72

Exercise of stock options 3 (22) 159 137

Shares to cover employee payroll tax

withholdings on stock issued under

benefit plans (1) (20) (20)

Tax benefits associated with stock-based

compensation plans 8 8

Purchases of treasury stock (17) (935) (935)

Other 22

Balance, December 31, 2011 157 $ 2 $ 2,347 $ 4,264 $ (8) $ (2,912) $ 22 $ 3,715

Net income 556 36 592

Other comprehensive income, net of tax 22 22

Dividends declared (130) (130)

Distributions to noncontrolling interests (38) (38)

Issuance of common stock under benefit

plans 1 4 17 21

Stock-based compensation expense 46 4 50

Exercise of stock options 3 (15) 177 162

Shares to cover employee payroll tax

withholdings on stock issued under

benefit plans (20) (20)

Tax benefits associated with stock-based

compensation plans 9 9

Purchases of treasury stock (3) (200) (200)

Other 3 3

Balance, December 31, 2012 158 $ 2 $ 2,371 $ 4,690 $ 14 $ (2,914) $ 23 $ 4,186

Net income 849 34 883

Other comprehensive loss, net of tax (22) (22)

Dividends declared (181) (181)

Distributions to noncontrolling interests (32) (32)

Issuance of common stock under benefit

plans 1 3 17 20

Stock-based compensation expense 24 4 28

Exercise of stock options 3 (9) 147 138

Shares to cover employee payroll tax

withholdings on stock issued under

benefit plans (1) (11) (11)

Tax benefits associated with stock-based

compensation plans 1 1

Purchases of treasury stock (17) (1,037) (1,037)

Other —

Balance, December 31, 2013 144 $ 2 $ 2,379 $ 5,358 $ (8) $ (3,783) $ 25 $ 3,973

The accompanying notes are an integral part of these statements.