Quest Diagnostics 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64

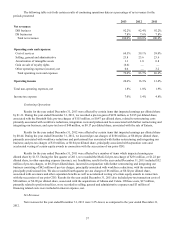

secured receivables credit facility and our senior unsecured revolving credit facility in the second quarter of 2011. In addition,

cash flows from investing activities for the year ended December 31, 2011 included capital expenditures of $161 million.

Cash Flows from Financing Activities

Net cash used in financing activities for the year ended December 31, 2013 was $1.1 billion, consisting primarily of

net decreases in debt of $4 million, purchases of treasury stock of $1.0 billion, dividend payments of $185 million and

distributions to noncontrolling interests of $32 million. These decreases were partially offset by proceeds from the exercise of

stock options and related tax benefits totaling $142 million. The net decrease in debt consists of $896 million of borrowings

and $900 million of repayments. Purchases of treasury stock were largely funded by the proceeds from the Ibrutinib Sale and

the HemoCue and Enterix sales.

The borrowings of $896 million and repayments of $900 million are primarily associated with our secured receivables

credit facility.

In December 2013, we renewed our existing secured receivables credit facility, which now matures on December 5,

2014. Interest on the secured receivables credit facility is based on rates that are intended to approximate commercial paper

rates for highly rated issuers. There were no outstanding borrowings under this facility at December 31, 2013.

Net cash used in financing activities for the year ended December 31, 2012 was $822 million, consisting primarily of a

net decrease in debt of $654 million, purchases of treasury stock of $200 million, dividend payments of $108 million and

distributions to noncontrolling interests of $38 million. These decreases were partially offset by proceeds from the exercise of

stock options and related tax benefits totaling $166 million. The net decrease in debt consists of $715 million of borrowings

and $1.4 billion of repayments.

The borrowings of $715 million represent amounts borrowed under our secured receivables credit facility. The

repayments of $1.4 billion represent the repayment of our $560 million term loan due May 2012, and $800 million of

repayments under our secured receivables credit facility.

Net cash provided by financing activities for the year ended December 31, 2011 was $64 million, consisting primarily

of net increases in debt of $1.0 billion, and proceeds from the exercise of stock options and related tax benefits totaling $141

million, partially offset by purchases of treasury stock of $935 million, dividend payments of $65 million, distributions to

noncontrolling interests of $36 million and $13 million of payments primarily related to debt issuance costs incurred in

connection with our senior notes offering in the first quarter of 2011 and our senior unsecured revolving credit facility in the

third quarter of 2011. The net increase in debt consists of $2.7 billion of borrowings and $1.7 billion of repayments.

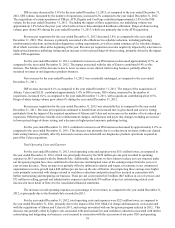

In February 2011, borrowings of $500 million under our secured receivables credit facility and $75 million under our

senior unsecured revolving credit facility, together with $260 million of cash on hand, were used to fund purchases of treasury

stock totaling $835 million. In addition, we completed a $1.25 billion senior notes offering in March 2011 (the “2011 Senior

Notes”). We used $485 million of the $1.24 billion in net proceeds from the 2011 Senior Notes offering, together with $90

million of cash on hand, to fund the repayment of $500 million outstanding under our secured receivables credit facility, and

the repayment of $75 million outstanding under our senior unsecured revolving credit facility. The remaining portion of the net

proceeds from the 2011 Senior Notes offering were used to fund our acquisition of Athena on April 4, 2011. The 2011 Senior

Notes are further described in Note 13 to the consolidated financial statements.

During the second quarter of 2011, $585 million and $30 million of borrowings under our secured receivables credit

facility and our senior unsecured revolving credit facility, respectively, together with cash on hand, were used to fund the

acquisition of Celera in May 2011. During the second quarter of 2011, proceeds from the sale of short-term marketable

securities acquired as part of the Celera acquisition totaling $214 million, together with cash on hand, were used to fund $500

million and $30 million of debt repayments under our secured receivables credit facility and our senior unsecured revolving

credit facility, respectively.

During the third quarter of 2011, $225 million of borrowings under our secured receivables credit facility were used

primarily to fund $159 million of debt repayments under our senior notes due July 2011 and purchases of treasury stock

totaling $50 million. Later in the quarter, we repaid $225 million of borrowings outstanding under our secured receivables

credit facility with cash on hand.

During the fourth quarter of 2011, $31 million of borrowings under our secured receivables credit facility, together

with cash on hand, were used primarily to fund $182 million of debt repayments under our term loan due May 2012 and