Quest Diagnostics 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 29

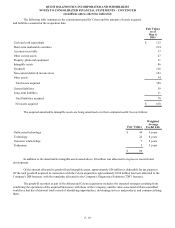

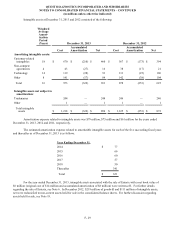

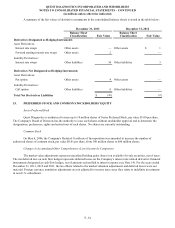

Intangible assets at December 31, 2013 and 2012 consisted of the following:

Weighted

Average

Amort-

ization

Period

(Years) December 31, 2013 December 31, 2012

Cost

Accumulated

Amortization Net Cost

Accumulated

Amortization Net

Amortizing intangible assets:

Customer-related

intangibles 18 $ 670 $ (210) $ 460 $ 567 $ (173) $ 394

Non-compete

agreements 4 43 (27) 16 38 (17)21

Technology 14 119 (28) 91 131 (25) 106

Other 8 141 (57) 84 142 (38) 104

Total 16 973 (322) 651 878 (253) 625

Intangible assets not subject to

amortization:

Tradenames 244 — 244 246 — 246

Other 1—11—1

Total intangible

assets $ 1,218 $ (322) $ 896 $ 1,125 $ (253) $ 872

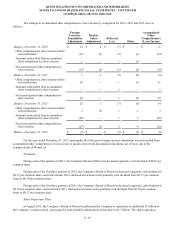

Amortization expense related to intangible assets was $79 million, $75 million and $61 million for the years ended

December 31, 2013, 2012 and 2011, respectively.

The estimated amortization expense related to amortizable intangible assets for each of the five succeeding fiscal years

and thereafter as of December 31, 2013 is as follows:

Year Ending December 31,

2014 $ 77

2015 66

2016 60

2017 57

2018 50

Thereafter 341

Total $ 651

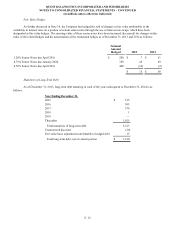

For the year ended December 31, 2013, intangible assets associated with the sale of Enterix with a net book value of

$6 million (original cost of $14 million and accumulated amortization of $8 million) were written-off. For further details

regarding the sale of Enterix, see Note 6. In December 2012, $219 million of goodwill and $111 million of intangible assets,

net were reclassified to non-current assets held for sale in the consolidated balance sheets. For further discussion regarding

assets held for sale, see Note 19.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)