Quest Diagnostics 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

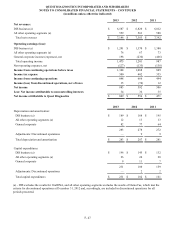

F- 50

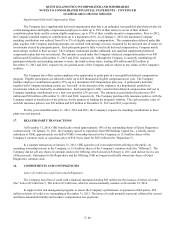

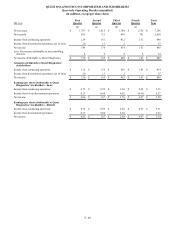

2012 (a)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Total

Year

(f) (g) (h) (i) (j)

Net revenues $ 1,909 $ 1,878 $ 1,822 $ 1,774 $ 7,383

Gross profit 800 776 741 701 3,018

Income from continuing operations 165 184 167 150 666

Income (loss) from discontinued operations, net of

taxes 3 2 5 (84) (74)

Net income 168 186 172 66 592

Less: Net income attributable to noncontrolling

interests 9 8 9 10 36

Net income attributable to Quest Diagnostics $ 159 $ 178 $ 163 $ 56 $ 556

Amounts attributable to Quest Diagnostics'

stockholders:

Income from continuing operations $ 156 $ 176 $ 158 $ 140 $ 630

Income (loss) from discontinued operations, net of

taxes 3 2 5 (84) (74)

Net income $ 159 $ 178 $ 163 $ 56 $ 556

Earnings per share attributable to Quest

Diagnostics' stockholders - basic:

Income from continuing operations $ 0.98 $ 1.10 $ 0.99 $ 0.88 $ 3.96

Income (loss) from discontinued operations 0.02 0.02 0.03 (0.53) (0.47)

Net income $ 1.00 $ 1.12 $ 1.02 $ 0.35 $ 3.49

Earnings per share attributable to Quest

Diagnostics' stockholders - diluted:

Income from continuing operations $ 0.97 $ 1.09 $ 0.98 $ 0.87 $ 3.92

Income (loss) from discontinued operations 0.02 0.02 0.03 (0.53) (0.46)

Net income $ 0.99 $ 1.11 $ 1.01 $ 0.34 $ 3.46

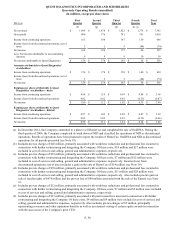

(a) In December 2012, the Company committed to a plan to sell HemoCue and completed the sale of OralDNA. During the

third quarter of 2006, the Company completed its wind down of NID and classified the operations of NID as discontinued

operations. Results of operations have been prepared to report the results of HemoCue, OralDNA and NID as discontinued

operations for all periods presented (see Note 19).

(b) Includes pre-tax charges of $45 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company. Of these costs, $18 million and $27 million were

included in cost of services and selling, general and administrative expenses, respectively.

(c) Includes pre-tax charges of $19 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company. Of these costs, $7 million and $12 million were

included in cost of services and selling, general and administrative expenses, respectively. Income (loss) from

discontinued operations, net of taxes includes a gain on the sale of HemoCue of $14 million (see Note 19).

(d) Includes pre-tax charges of $39 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company. Of these costs, $11 million and $28 million were

included in cost of services and selling, general and administrative expenses, respectively. Also includes pre-tax gain on

sale of royalty rights of $474 million and the pre-tax loss of $40 million associated with the sale of the Enterix (see Note

6).

(e) Includes pre-tax charges of $12 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company. Of these costs, $7 million and $5 million were included

in cost of services and selling, general and administrative expenses, respectively.

(f) Includes pre-tax charges of $13 million, primarily associated with professional fees incurred in connection with further

restructuring and integrating the Company. Of these costs, $4 million and $9 million were included in cost of services and

selling, general and administrative expenses, respectively. Also includes pre-tax charges of $7 million, principally

representing severance and other separation benefits as well as accelerated vesting of certain equity awards in connection

with the succession of the Company's prior CEO.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

Quarterly Operating Results (unaudited)

(in millions, except per share data)