Quest Diagnostics 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 24

The unrealized gains and losses included in earnings for the year ended December 31, 2013 are reported in other non-

operating income.

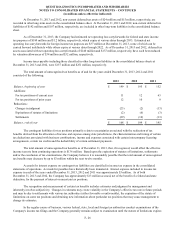

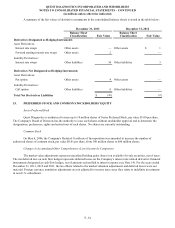

The carrying amounts of cash and cash equivalents, accounts receivable, accounts payable and accrued expenses

approximate fair value based on the short maturities of these instruments. At December 31, 2013, the fair value of the

Company’s debt was estimated at $3.5 billion, which exceeded the carrying value by $184 million. At December 31, 2012, the

fair value of the Company's debt was estimated at $3.8 billion, which exceeded the carrying value by $481 million. Principally

all of the Company's debt is classified within Level 1 of the fair value hierarchy because the fair value of the debt is estimated

based on rates currently offered to the Company with identical terms and maturities, using quoted active market prices and

yields, taking into account the underlying terms of the debt instruments.

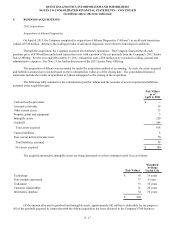

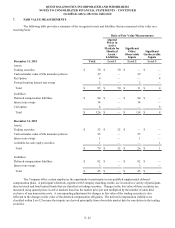

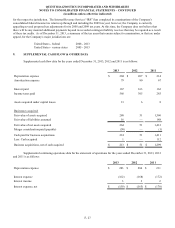

The following table provides a summary of the recognized assets and liabilities that are measured at fair value on a

non-recurring basis:

Basis of Fair Value Measurements

Quoted

Prices in

Active

Markets for

Identical

Assets /

Liabilities

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs Total Loss

December 31, 2012 Level 1 Level 2 Level 3

Net assets held for sale $ 312 $ — $ 312 $ — $ 78

In connection with the Company's agreement to sell HemoCue and upon classification of this business as discontinued

operations during the fourth quarter of 2012, net assets held for sale with a carrying amount of $390 million were written down

to their fair value of $317 million, less estimated costs to sell of $5 million (or $312 million), resulting in a loss of $78 million.

This charge was included in income (loss) from discontinued operations, net of taxes. Net assets held for sale at December 31,

2012, were classified within Level 2 and were measured based upon the estimated proceeds associated with the agreement to

sell HemoCue.

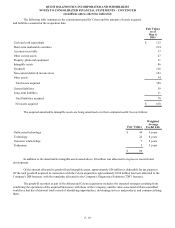

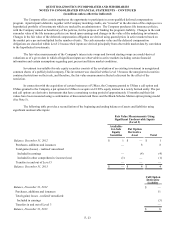

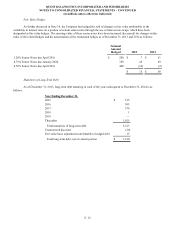

8. TAXES ON INCOME

The Company's pre-tax income from continuing operations consisted of $1.3 billion, $1.1 billion and $836 million

from U.S. operations and $19 million, $18 million and $13 million from foreign operations for the years ended December 31,

2013, 2012 and 2011, respectively.

For the year ended December 31, 2013, pre-tax income from continuing operations in the U.S., income tax expense

and the effective tax rate, including the state and local income tax rate, net of federal benefit, were impacted by the gain on sale

of royalty rights. For further details regarding the sale of royalty rights, see Note 6.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)