Quest Diagnostics 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

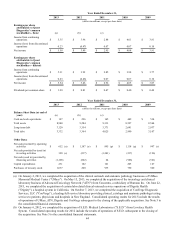

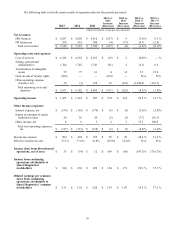

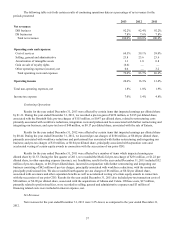

anticipated healthcare utilization. DIS revenue per requisition for the year ended December 31, 2013 decreased 3.6% from the

prior year. The decrease in our DIS revenue per requisition is primarily associated with the Medicare fee schedule reductions,

as well as certain commercial fee schedule changes, all of which went into effect at the beginning of the year. Revenue per

requisition was also negatively impacted by a decrease in higher priced anatomic pathology testing and an increase in lower

priced drugs-of-abuse testing, primarily driven by the impact of the Advanced Toxicology Network ("ATN") acquisition. DS

revenues were down less than 1% as compared to the prior year. Income from continuing operations attributable to Quest

Diagnostics' stockholders was $814 million for the year ended December 31, 2013. This increase over the prior year is

principally due to the after-tax gain of $298 million related to the sale of future royalty rights of ibrutinib ("Ibrutinib Sale") and

was partially offset by a $40 million loss on sale associated with Enterix, our colorectal cancer screening test business

("Enterix"). Earnings per diluted share from continuing operations was $5.31 for the year ended December 31, 2013. This

increase over the prior year period is primarily due to the Ibrutinib Sale and the impact of common stock repurchases on our

diluted share count, partially offset by lower operating income (excluding the Ibrutinib Sale) as a result of lower revenues.

Five-point Strategy

We have made good progress on the execution of our five-point strategy during 2013 as follows:

• As part of our effort to restore growth, we acquired the clinical outreach and anatomic pathology businesses of UMass

Memorial Medical Center ("UMass"); the toxicology and clinical laboratory business of ATN; certain lab-related

clinical outreach service operations of Dignity Health ("Dignity"); and the operations of ConVerge Diagnostic

Services, LLC ("ConVerge").

• As part of the refocus on our DIS business we divested non-core assets such as our diagnostic point-of-care testing

business ("HemoCue"), the ibrutinib royalty rights and Enterix for gross proceeds of approximately $800 million.

• Our new clinical franchises organization is enabling us to focus on serving market needs and filling gaps in care

resulting in many new service offerings, including BRCAvantage™, which is intended to significantly broaden patient

and provider access to testing for the BRCA1 and BRCA2 gene mutations.

• As part of our simplification of the organization to enable growth and productivity, we restructured our organization to

eliminate silos in our core business, provided leadership in defined geographies, and eliminated three management

layers and over 500 management positions within the organization. We created one commercial organization in our

DIS business, that is centrally led and focused on local customer needs.

• Our laboratory professional services team continues to expand its pipeline of hospitals and IDNs interested in working

with us to improve outcomes and reduce costs.

• Our cost excellence program, Invigorate, realized more than $250 million in savings this year.

• We returned to investors a majority of our free cash flow and paid a quarterly common stock dividend of $0.30 per

common share, which represents a 76% increase as compared to 2012.

• We repurchased approximately $1 billion of our common stock as part of our stock repurchase program.

• In January 2014, we announced that our Board of Directors authorized a 10% increase in the quarterly cash dividend

for the first quarter of 2014 from $0.30 per common share to $0.33 per common share.

Invigorate Program

The diagnostic testing industry is labor intensive. Employee compensation and benefits constitute approximately one-

half of our total costs and expenses. In addition, performing diagnostic testing involves significant fixed costs for facilities and

other infrastructure required to obtain, transport and test specimens. Therefore, relatively small changes in volume can have a

significant impact on profitability in the short-term.

We are engaged in a multi-year program called Invigorate. The Invigorate program is intended to mitigate the impact

of continued reimbursement pressures and labor and benefit cost increases, free up additional resources to invest in science,

innovation and other growth initiatives and enable us to improve quality and operating profitability. As a result of our

Invigorate program, we have delivered more than $250 million in realized savings in 2013. This has positioned us to exceed our

$600 million goal in run rate savings by the end of 2014 and are now expecting run rate savings that will approach $700 million

by the end of 2014, compared to 2011. We continue to target savings from the Invigorate program of $1 billion over time.

In connection with our Invigorate program, we launched multiple management restructuring initiatives aimed at

driving operational excellence and restoring growth. These restructuring initiatives were primarily undertaken to eliminate

multiple layers from the organization, migrate certain aspects of our support functions to an outsourcing model and optimize

the use of our facilities and infrastructure. As of December 31, 2013, we recorded approximately $134 million of pre-tax

employee separation costs and other restructuring related costs associated with these programs.