Quest Diagnostics 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

Healthcare insurers, which typically negotiate directly or indirectly on behalf of their members, represent

approximately one-half of our DIS volumes and one-half of our net revenues from our DIS business. Larger healthcare insurers

typically contract with large commercial clinical laboratories because they can provide services to their members on a national

or regional basis. In addition, larger commercial clinical laboratories are better able to achieve the low-cost structures necessary

to profitably service the members of large healthcare insurers and can provide test utilization data across various products in a

consistent format.

The trend of consolidation among physicians, hospitals, employers, healthcare insurers and other intermediaries has

continued, resulting in fewer but larger customers and payers with significant bargaining power to negotiate fee arrangements

with healthcare providers, including clinical laboratories. Healthcare insurers sometimes require that diagnostic testing service

providers accept discounted fee structures or assume all or a portion of the utilization risk associated with providing testing

services to certain members through capitated payment arrangements. Under these capitated payment arrangements, we and the

healthcare insurers agree to a predetermined monthly reimbursement rate for each member enrolled in a restricted plan,

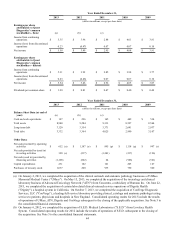

generally regardless of the number or cost of services provided by us. In 2013, we derived approximately 12% of our testing

volume and 4% of our DIS net revenues from capitated payment arrangements.

Most healthcare insurers also offer programs such as PPOs, POS plans, CDHPs, high deductible plans and other

coverage programs. Most of our agreements with major health plans are non-exclusive arrangements. Certain health plans have

limited their diagnostics information services network to only a single national provider, seeking to obtain improved pricing.

Health plans also are narrowing their provider networks. To the extent that plans and programs require greater levels of patient

cost-sharing, this could negatively impact patient collection experience.

Despite the general trend of increased choice for patients in selecting a healthcare provider, some healthcare insurers

may actively seek to limit the choice of patients and physicians if they feel it will give them increased leverage to negotiate

lower fees, by consolidating services with a single or limited network of contracted providers.

We also may be a member of a “complementary network.” A complementary network is generally a set of contractual

arrangements that a third party will maintain with various providers which provide discounted fees for the benefit of its

customers. A member of a health plan may choose to access a non-contracted provider that is a member of a complementary

network; if so, the provider will be reimbursed at a rate negotiated by the complementary network.

We expect that reimbursements for the diagnostic testing industry will continue to remain under pressure. Today, the

federal government and many state governments face serious budget deficits and healthcare spending is subject to reductions,

and efforts to reduce reimbursements and stringent cost controls by government and other payers for existing tests may

continue. However, we believe that as new tests are developed which either improve on the effectiveness of existing tests or

provide new diagnostic capabilities, the government and other payers will add these tests as covered services, because of the

importance of laboratory testing in assessing and managing the health of patients. We continue to emphasize the importance

and the high value of laboratory testing with healthcare insurers and government payers at the federal and state level.

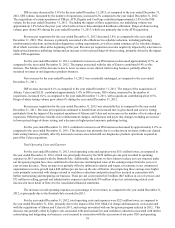

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America requires us to make estimates and assumptions and select accounting policies that affect our reported

financial results and the disclosure of contingent assets and liabilities.

While many operational aspects of our business are subject to complex federal, state and local regulations, the

accounting for most of our business is generally straightforward, with net revenues primarily recognized upon completion of

the testing process. Our revenues are primarily comprised of a high volume of relatively low-dollar transactions, and about one-

half of our total costs and expenses consist of employee compensation and benefits. Due to the nature of our business, several

of our accounting policies involve significant estimates and judgments:

• revenues and accounts receivable associated with DIS;

• reserves for general and professional liability claims;

• reserves for other legal proceedings;

• accounting for and recoverability of goodwill; and

• accounting for stock-based compensation expense.