Quest Diagnostics 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

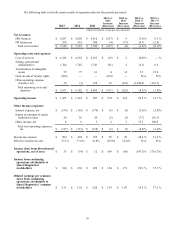

DIS revenue decreased by 3.4% for the year ended December 31, 2013, as compared to the year ended December 31,

2012. DIS volume, measured by the number of requisitions, increased 0.2% compared to the year ended December 31, 2012.

The acquisitions of certain operations of UMass, ATN, Dignity and ConVerge contributed approximately 2.0% to the DIS

volume for the year ended December 31, 2013. Excluding the impact of these acquisitions, our underlying volume was

approximately 1.8% below the prior year, which reflects lower than anticipated healthcare utilization. Drugs-of-abuse testing

volume grew about 18% during the year ended December 31, 2013, which was primarily due to the ATN acquisition.

Revenue per requisition for the year ended December 31, 2013 decreased 3.6%, as compared to the year ended

December 31, 2012. This decrease is primarily associated with a Medicare fee schedule reduction, including pathology

reimbursement reductions and molecular diagnostics coding requirements, as well as certain commercial fee schedule changes,

all of which went into effect at the beginning of the year. Revenue per requisition was also negatively impacted by a decrease in

higher priced anatomic pathology testing and an increase in lower priced drugs-of-abuse testing, primarily driven by the impact

of the ATN acquisition.

For the year ended December 31, 2013, combined revenues in our DS businesses decreased approximately 0.7%, as

compared to the year ended December 31, 2012. The impact associated with the sale of Enterix contributed 0.4% to this

decrease. The balance of this decrease is due to lower revenues in our clinical trials testing business, partially offset by

increased revenues in our diagnostics products business.

Net revenues for the year ended December 31, 2012 were essentially unchanged, as compared to the year ended

December 31, 2011.

DIS revenue increased 0.1% as compared to the year ended December 31, 2011. The impact of the acquisitions of

Athena, Celera and S.E.D. contributed approximately 1.0% to DIS revenue. DIS volume, measured by the number of

requisitions, increased 0.2%, as compared to the year ended December 31, 2011, with acquisitions contributing about 0.5%.

Drugs-of-abuse testing volume grew about 6% during the year ended December 31, 2012.

Revenue per requisition for the year ended December 31, 2012 was essentially flat, as compared to the year ended

December 31, 2011. Revenue per requisition continued to benefit from an increased mix in gene-based and esoteric testing,

particularly from the impact of the acquired operations of Athena and Celera and an increase in the number of tests ordered per

requisition. Offsetting these benefits were reimbursement changes, and business and payer mix changes including an increase

in lower priced drugs-of-abuse testing, and a decrease in higher priced anatomic pathology testing.

For the year ended December 31, 2012, combined revenues in our DS businesses decreased by approximately 2.9%, as

compared to the year ended December 31, 2011. This decrease was primarily due to a reduction in revenues within our clinical

trials testing business, partially offset by increased revenues associated with our diagnostics products operations acquired as

part of the Celera acquisition.

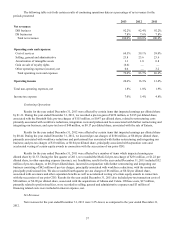

Total Operating Costs and Expenses

For the year ended December 31, 2013, total operating costs and expenses were $511 million lower, as compared to

the year ended December 31, 2012, which was principally driven by the $474 million pre-tax gain recorded in operating

expenses in 2013 associated with the Ibrutinib Sale. Additionally, the actions we have taken to reduce our cost structure under

our Invigorate program have also contributed to this decrease and mitigated some of the earnings impact from the year over

year revenue decrease. These savings were partially offset by inflation in salaries and wages, investments in our commercial

organization to restore growth and a $40 million pre-tax loss on the sale of Enterix. Also impacting these savings were higher

costs primarily associated with charges related to workforce reductions and professional fees incurred in connection with

further restructuring and integrating our business. These pre-tax costs totaled $115 million ($43 million in cost of services and

$72 million in selling, general and administrative expenses) and include $76 million of pre-tax restructuring related costs

discussed in more detail in Note 4 to the consolidated financial statements.

The decrease in total operating expenses as a percentage of net revenues, as compared to the year ended December 31,

2012, is principally due to the Ibrutinib Sale recorded in 2013.

For the year ended December 31, 2012, total operating costs and expenses were $223 million lower, as compared to

the year ended December 31, 2011, primarily due to the impact of the 2011 Medi-Cal charge and transaction costs associated

with the acquisitions of Athena and Celera in 2011, and savings associated with our Invigorate program realized in 2012. This

decrease was partially offset by higher costs associated with professional fees and workforce reductions associated with further

restructuring and integrating our business, costs incurred in connection with the succession of our prior CEO and operating