Quest Diagnostics 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F- 36

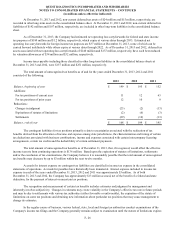

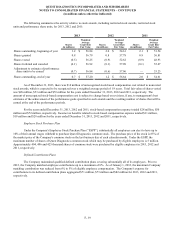

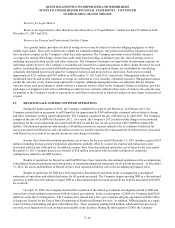

authorization has no set expiration or termination date. At December 31, 2013, $828 million remained available under the

Company’s share repurchase authorization.

In January 2012, the Company’s Board of Directors authorized the Company to repurchase an additional $1 billion of

the Company’s common stock, increasing the total available authorization at that time to $1.1 billion.

Share Repurchases

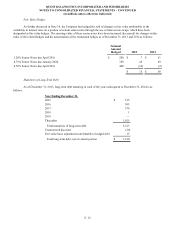

On April 19, 2013, the Company entered into an accelerated share repurchase agreement ("ASR") with a financial

institution to repurchase $450 million of the Company’s common stock as part of the Company’s Common Stock repurchase

program. The ASR was structured as a combination of two transactions: (1) a treasury stock repurchase and (2) a forward

contract which permitted the Company to purchase shares immediately with the final purchase price of those shares determined

by the volume weighted average price of the Company's common stock during the purchase period, less a fixed discount.

Under the ASR, the Company paid $450 million to the financial institution and received 7.6 million shares of common stock,

resulting in a final price per share of $59.46. The Company initially received 7.2 million shares of its common stock during the

second quarter of 2013 and received an additional 0.4 million shares upon completion of the ASR during the third quarter of

2013. As of June 30, 2013, the Company recorded this transaction as an increase to treasury stock of $405 million, and

recorded the remaining $45 million as a decrease to additional paid-in capital in the Company's consolidated balance sheets.

Upon completion of the ASR in the third quarter of 2013, the Company reclassified the $45 million to treasury stock from

additional paid-in capital on the consolidated balance sheets.

On September 4, 2013, the Company entered into an ASR with a financial institution to repurchase $350 million of the

Company’s common stock as part of the Company’s Common Stock repurchase program. The ASR was structured as a

combination of two transactions: (1) a treasury stock repurchase and (2) a forward contract which permitted the Company to

purchase shares immediately with the final purchase price of those shares determined by the volume weighted average price of

the Company's common stock during the purchase period, less a fixed discount. Under the ASR, the Company paid $350

million to the financial institution and received 5.8 million shares of common stock, resulting in a final price per share of

$60.73. The Company initially received 4.7 million shares of its common stock during the third quarter of 2013 and received

an additional 1.1 million shares upon completion of the ASR during the fourth quarter of 2013. As of September 30, 2013, the

Company recorded this transaction as an increase to treasury stock of $280 million, and recorded the remaining $70 million as a

decrease to additional paid-in capital in the Company's consolidated balance sheets. Upon completion of the ASR in the fourth

quarter of 2013, the Company reclassified the $70 million to treasury stock from additional paid-in capital on the consolidated

balance sheets.

In addition to the ASRs previously discussed, the Company repurchased shares of its common stock on the open

market. For the year ended December 31, 2013, the Company repurchased an additional 4.1 million shares of its common stock

at an average price of $57.63 per share for a total of $237 million.

For the year ended December 31, 2012, the Company repurchased 3.4 million shares of its common stock at an

average price of $58.31 per share for a total of $200 million.

For the year ended December 31, 2011, the Company repurchased 17.3 million shares of its common stock at an

average price of $54.05 per share for $935 million, including 15.4 million shares purchased in the first quarter from SB

Holdings Capitial Inc., a wholly-owned subsidiary of GlaxoSmithKline plc., at an average price of $54.30 per share for a total

of $835 million.

For the years ended December 31, 2013, 2012 and 2011 the Company reissued 3 million shares, 4 million shares and 4

million shares, respectively, for employee benefit plans.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)