Quest Diagnostics 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Overview

Our Company

Diagnostic Information Services

Quest Diagnostics is the world's leading provider of Diagnostic Information Services ("DIS") providing insights

through clinical testing and related services that empower and enable patients, physicians, hospitals, IDNs, health plans,

employers and others to make better healthcare decisions. Our DIS business makes up over 90% of our consolidated net

revenues. We offer the broadest access in the United States to DIS through our nationwide network of laboratories and

Company-owned patient service centers and we are the leading provider of clinical testing including routine testing, gene-based

and esoteric testing, anatomic pathology services, and drugs-of-abuse testing, as well as related services and insights. We

provide interpretive consultation throughout our organization, with the largest medical and scientific staff in the industry and

hundreds of M.D.s and Ph.D.s, many of whom are recognized leaders in their fields.

The clinical testing that we perform is an essential element in the delivery of healthcare services. Physicians use

clinical testing to assist in detection, diagnosis, evaluation, monitoring and treatment of diseases and other medical conditions.

The U.S. clinical testing industry consists of two segments. One segment, which we believe makes up approximately 40% of

the total industry, includes testing done within hospitals, including both inpatient and outpatient testing. The second segment,

which we believe makes up approximately 60% of the total industry, includes testing done outside of hospitals, including

hospital outreach testing and testing done in commercial clinical laboratories, physician-office laboratories and other locations.

Within the second segment, we believe that hospital outreach has been increasing share in the last few years. We believe that

hospital-affiliated laboratories account for approximately 60% of the total industry, commercial clinical laboratories

approximately one-third and physician-office laboratories and other locations account for the balance.

The clinical testing industry is subject to seasonal fluctuations in operating results and cash flows. Typically, testing

volume declines during the summer months, year-end holiday periods and other major holidays, reducing net revenues and

operating cash flows below annual averages. Testing volume is also subject to declines due to severe weather or other events,

which can deter patients from having testing performed and which can vary in duration and severity from year to year.

Additionally, orders for diagnostic testing generated from physician offices, hospitals and employers can be affected by factors

such as changes in the United States economy, which affect the number of unemployed and uninsured, and design changes in

healthcare plans, which affect the number of physician office and hospital visits.

Diagnostic Solutions

Our Diagnostic Solutions ("DS") business, which represents the balance of our revenues, is comprised of our risk

assessment services, clinical trials testing, diagnostic products and healthcare information technology businesses. Through our

DS businesses, we offer a variety of solutions for insurers, healthcare providers and others. We are the leading provider of risk

assessment services for the life insurance industry. We also are a leading provider of testing for clinical trials. In addition, we

offer healthcare organizations and clinicians robust information technology solutions and diagnostic products, including test

kits.

2013 Highlights

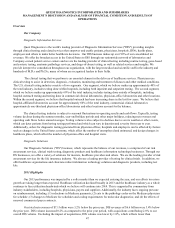

Our 2013 performance was impacted by a softer market than we expected entering the year, and our efforts to restore

growth are taking longer than expected. Healthcare utilization declined broadly in 2013 and the healthcare industry as a whole

continues to face utilization headwinds which we believe will continue into 2014. This is supported by commentary from

industry stakeholders, including hospitals, physicians, payers and suppliers. Additionally, the industry faces ongoing pressure

on reimbursement, including: (1) reductions in Medicare payments; (2) cuts to the pathology codes on the Medicare physician

fee schedule; (3) changes to Medicare fee schedules and coding requirements for molecular diagnostics; and (4) the effects of

renewed commercial payer contracts.

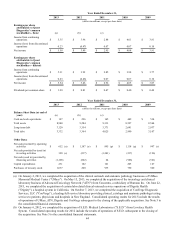

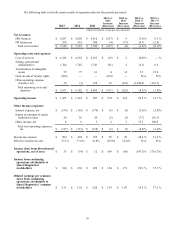

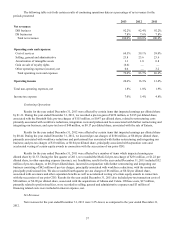

Our total net revenues of $7.1 billion were 3.2% below the prior year. DIS revenues of $6.6 billion were 3.4% below

the prior year. DIS volume increased 0.2% as compared to the prior year period, with acquisitions contributing 2.0% to our

overall DIS volume. Excluding the impact of acquisitions, DIS volume was lower by 1.8%, which reflects lower than