Quest Diagnostics 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

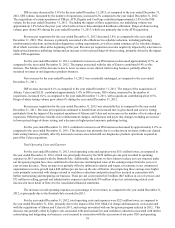

Based upon our most recent annual impairment test completed during the fourth quarter of the fiscal year ended

December 31, 2013, we concluded that goodwill was not impaired.

At December 31, 2012, we classified the assets and liabilities of HemoCue as held for sale in the accompanying

consolidated balance sheets. Prior to its classification as held for sale, HemoCue was an aggregated component within the

Diagnostic Products reporting unit based upon its similar economic characteristics with other diagnostic products businesses in

this reporting unit. In the fourth quarter of 2012, we received several offers to purchase HemoCue, and in February 2013, we

entered into an agreement to sell HemoCue. The proposed consideration to be received indicated that the carrying value of

HemoCue was in excess of its fair value. As a result, we re-assessed the fair value of the net assets of HemoCue and determined

that the goodwill associated with this business was impaired and recorded a pre-tax impairment charge of $78 million in

discontinued operations in December 2012.

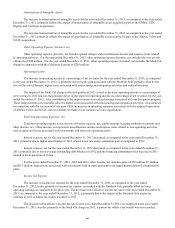

Accounting for stock-based compensation expense

We record stock-based compensation as a charge to earnings, net of the estimated impact of forfeited awards. As such,

we recognize stock-based compensation cost only for those stock-based awards that are estimated to ultimately vest over their

requisite service period, based on the vesting provisions of the individual grants. The process of estimating the fair value of

stock-based compensation awards and recognizing stock-based compensation cost over their requisite service periods involves

significant assumptions and judgments.

We estimate the fair value of stock option awards on the date of grant using a lattice-based option-valuation model

which requires management to make certain assumptions regarding: (i) the expected volatility in the market price of the

Company's common stock; (ii) dividend yield; (iii) risk-free interest rates; and (iv) the period of time employees are expected to

hold the award prior to exercise (referred to as the expected holding period). The expected volatility under the lattice-based

option-valuation model is based on the current and historical implied volatilities from traded options of our common stock. The

dividend yield is based on the approved annual dividend rate in effect and current market price of the underlying common stock

at the time of grant. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for bonds

with maturities ranging from one month to ten years. The expected holding period of the awards granted is estimated using the

historical exercise behavior of employees. In addition, we estimate the expected impact of forfeited awards and recognize

stock-based compensation cost only for those awards expected to vest. We use historical experience to estimate projected

forfeitures. If actual forfeiture rates are materially different from our estimates, stock-based compensation expense could be

significantly different from what we have recorded in the current period. We periodically review actual forfeiture experience

and revise our estimates, as considered necessary. The cumulative effect on current and prior periods of a change in the

estimated forfeiture rate is recognized as compensation cost in earnings in the period of the revision.

The terms of our performance share unit grants allow the recipients of such awards to earn a variable number of shares

based on the achievement of the performance goals specified in the awards. Stock-based compensation expense associated with

performance share units is recognized based on management's best estimates of the achievement of the performance goals

specified in such awards and the resulting number of shares that will be earned. If the actual number of performance share units

earned is different from our estimates, stock-based compensation could be significantly different from what we have recorded

in the current period. The cumulative effect on current and prior periods of a change in the estimated number of performance

share units expected to be earned is recognized as compensation cost in earnings in the period of the revision. While the

assumptions used to calculate and account for stock-based compensation awards represent management's best estimates, these

estimates involve inherent uncertainties and the application of management's judgment. As a result, if revisions are made to our

assumptions and estimates, our stock-based compensation expense could vary significantly from period to period. In addition,

the number of awards made under our equity compensation plans, changes in the design of those plans, the price of our shares

and the performance of our Company can all cause stock-based compensation expense to vary from period to period.