Quest Diagnostics 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 28

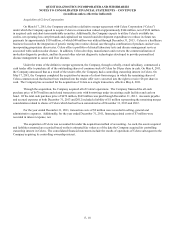

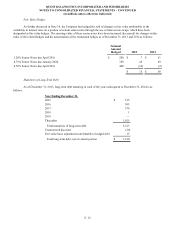

10. PROPERTY, PLANT AND EQUIPMENT

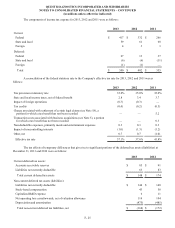

Property, plant and equipment at December 31, 2013 and 2012 consisted of the following:

2013 2012

Land $30$28

Buildings and improvements 365 353

Laboratory equipment, furniture and fixtures 1,248 1,212

Leasehold improvements 452 436

Computer software developed or obtained for internal use 581 521

Construction-in-progress 130 74

2,806 2,624

Less: Accumulated depreciation and amortization (2,001)(1,868)

Total $ 805 $ 756

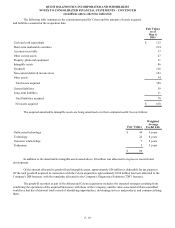

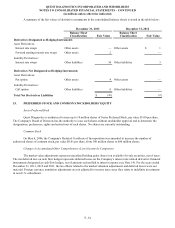

11. GOODWILL AND INTANGIBLE ASSETS

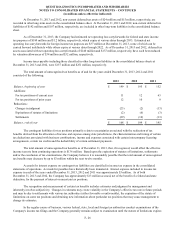

The changes in goodwill for the years ended December 31, 2013 and 2012 were as follows:

2013 2012

Balance, beginning of year $ 5,536 $ 5,796

Goodwill acquired during the year 150 28

Goodwill impairment and write-off associated with sale of businesses during the year (37)(85)

Reclassification to non-current assets held for sale — (219)

Increase related to foreign currency translation — 16

Balance, end of year $ 5,649 $ 5,536

Approximately 90% of the Company’s goodwill as of December 31, 2013 and 2012 was associated with its DIS

business.

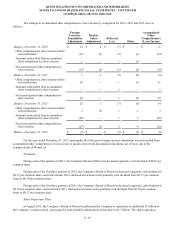

For the year ended December 31, 2013, goodwill acquired was principally associated with the UMass, ATN, Dignity

and ConVerge acquisitions. Goodwill acquired associated with the UMass, ATN and Dignity acquisitions, totaling $131

million, is deductible for tax purposes. Goodwill acquired associated with the ConVerge acquisition totaled $19 million, of

which $4 million is deductible for tax purposes. These acquisitions also resulted in $108 million of intangible assets,

principally comprised of customer-related intangibles. For the year ended December 31, 2012, goodwill acquired was

principally associated with the acquisition of S.E.D., which is deductible for tax purposes. This acquisition resulted in $19

million of intangible assets, principally comprised of customer-related intangibles. See Note 5 for further details regarding

acquisitions.

For the year ended December 31, 2013, the $37 million of goodwill written-off was associated with the sale of Enterix.

For the year ended December 31, 2012, goodwill impairment was associated with the agreement to sell HemoCue and the

write-off of goodwill was associated with the sale of OralDNA. For further details regarding the sale of Enterix, see Note 6.

For further details regarding goodwill included in non-current assets held for sale as of December 31, 2012, see Note 19.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)