Quest Diagnostics 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 38

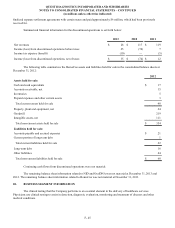

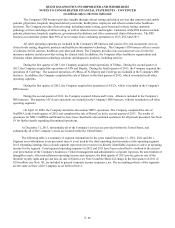

The fair value of each stock option award granted was estimated on the date of grant using a lattice-based option-

valuation model. The expected volatility under the lattice-based option-valuation model was based on the current and the

historical implied volatilities from traded options of the Company's common stock. The dividend yield was based on the

approved annual dividend rate in effect and current market price of the underlying common stock at the time of grant. The risk-

free interest rate of each stock option granted was based on the U.S. Treasury yield curve in effect at the time of grant for bonds

with maturities ranging from 1 month to 10 years. The expected holding period of the options granted was estimated using the

historical exercise behavior of employees. The weighted average assumptions used in valuing options granted in the periods

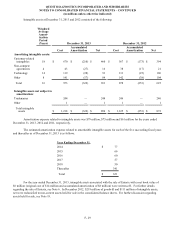

presented are:

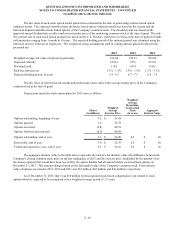

2013 2012 2011

Weighted average fair value of options at grant date $12.64 $15.87 $18.08

Expected volatility 25.8% 27% 27.2%

Dividend yield 1.4% 0.9% 0.8%

Risk-free interest rate 1.1% - 1.3% 1.3% - 1.5% 2.7% - 3.1%

Expected holding period, in years 5.5 - 6.7 6.7 - 7.5 6.8 - 7.6

The fair value of restricted stock awards and performance share units is the average market price of the Company's

common stock at the date of grant.

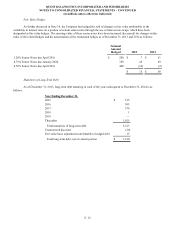

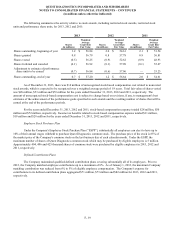

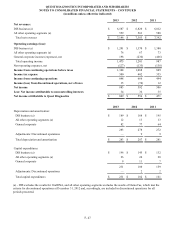

Transactions under the stock option plans for 2013 were as follows:

Shares

(in millions)

Weighted

Average

Exercise Price

Weighted

Average

Remaining

Contractual

Term

(in years)

Aggregate

Intrinsic Value

Options outstanding, beginning of year 7.8 $ 51.68

Options granted 1.6 56.78

Options exercised (2.8) 49.19

Options forfeited and canceled (0.3) 49.69

Options outstanding, end of year 6.3 $ 54.20 6.2 $ 10

Exercisable, end of year 3.8 $ 52.39 2.6 $ 10

Vested and expected to vest, end of year 6.1 $ 54.16 6.2 $ 10

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the

Company's closing common stock price on the last trading day of 2013 and the exercise price, multiplied by the number of in-

the-money options) that would have been received by the option holders had all option holders exercised their options on

December 31, 2013. This amount changes based on the fair market value of the Company's common stock. Total intrinsic

value of options exercised in 2013, 2012 and 2011 was $32 million, $45 million and $43 million, respectively.

As of December 31, 2013, there was $10 million of unrecognized stock-based compensation cost related to stock

options which is expected to be recognized over a weighted average period of 1.9 years.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)