Quest Diagnostics 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F- 17

5. BUSINESS ACQUISITIONS

2011 Acquisitions

Acquisition of Athena Diagnostics

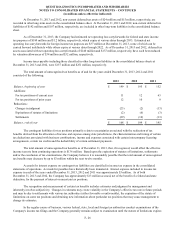

On April 4, 2011, the Company completed its acquisition of Athena Diagnostics (“Athena”) in an all-cash transaction

valued at $740 million. Athena is the leading provider of advanced diagnostic tests related to neurological conditions.

Through the acquisition, the Company acquired all of Athena's operations. The Company financed the all-cash

purchase price of $740 million and related transaction costs with a portion of the net proceeds from the Company's 2011 Senior

Notes Offering. For the year ended December 31, 2011, transaction costs of $8 million were recorded in selling, general and

administrative expenses. See Note 13 for further discussion of the 2011 Senior Notes Offering.

The acquisition of Athena was accounted for under the acquisition method of accounting. As such, the assets acquired

and liabilities assumed are recorded based on their estimated fair values as of the closing date. The consolidated financial

statements include the results of operations of Athena subsequent to the closing of the acquisition.

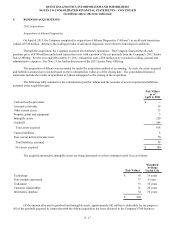

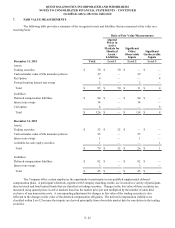

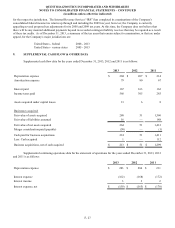

The following table summarizes the consideration paid for Athena and the amounts of assets acquired and liabilities

assumed at the acquisition date:

Fair Values

as of

April 4, 2011

Cash and cash equivalents $—

Accounts receivable 18

Other current assets 13

Property, plant and equipment 3

Intangible assets 220

Goodwill 564

Total assets acquired 818

Current liabilities 8

Non-current deferred income taxes 70

Total liabilities assumed 78

Net assets acquired $ 740

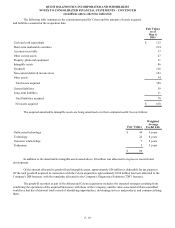

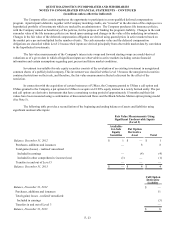

The acquired amortizable intangible assets are being amortized over their estimated useful lives as follows:

Fair Values

Weighted

Average

Useful Life

Technology $ 93 16 years

Non-compete agreement 37 4 years

Tradename 35 10 years

Customer relationships 21 20 years

Informatics database 34 10 years

$ 220

Of the amount allocated to goodwill and intangible assets, approximately $42 million is deductible for tax purposes.

All of the goodwill acquired in connection with the Athena acquisition has been allocated to the Company's DIS business.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)