Quest Diagnostics 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F- 51

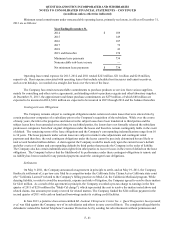

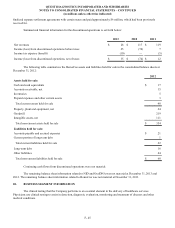

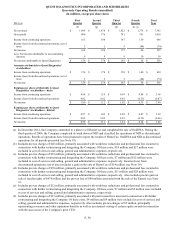

(g) Includes pre-tax charges of $13 million, primarily associated with professional fees and workforce reductions incurred in

connection with further restructuring and integrating the Company. Of these costs, $5 million and $8 million were included

in cost of services and selling, general and administrative expenses, respectively. Also includes pre-tax charges of $3

million, principally representing severance and other separation benefits as well as accelerated vesting of certain equity

awards in connection with the succession of the Company's prior CEO.

(h) Includes pre-tax charges of $44 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company. Of these costs, $20 million and $24 million were

included in cost of services and selling, general and administrative expenses, respectively.

(i) Includes pre-tax charges of $36 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company. Of these costs, $23 million and $13 million were

included in cost of services and selling, general and administrative expenses, respectively. In addition, management

estimates that the impact of severe weather during the fourth quarter adversely affected operating income by $16 million.

(j) Includes related charges in discontinued operations for the asset impairment associated with HemoCue and the loss on sale

associated with OralDNA totaling $86 million. Discontinued operations also includes an $8 million income tax expense

related to the re-valuation of deferred tax assets associated with HemoCue and a $4 million income tax benefit related to

the remeasurement of deferred taxes associated with HemoCue as a result of an enacted income tax rate change in Sweden.

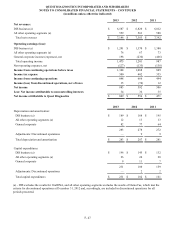

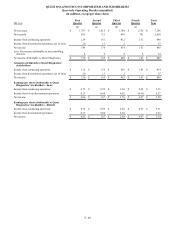

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

Quarterly Operating Results (unaudited)

(in millions, except per share data)